How to use Your Year-End Adjustment

- For:

- Employees

- Plans:

- Simple HRHR Essentials0 YenHR Strategy

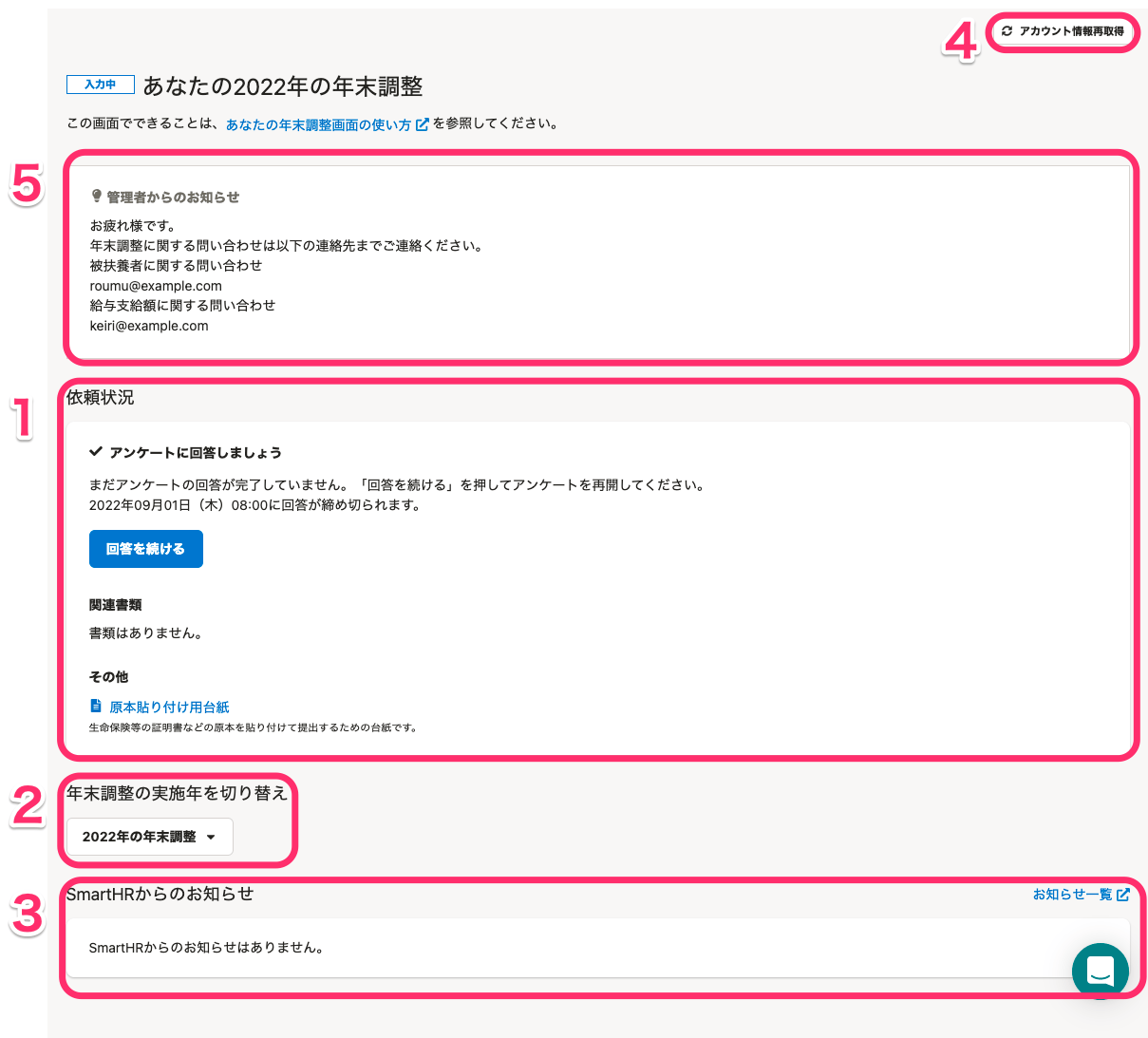

This page explains how to use the "Your Year-End Adjustment" page, which is a part of the year-end adjustment feature used by employees.

About Your Year-End Adjustment

To access "Your Year-End Adjustment" (あなたの年末調整), first log in to SmartHR and press the [Year-End Adjustment] (年末調整) button in the App menu.

From Your Year-End Adjustment, you can answer the year-end adjustment survey and check all documents that have been created.

This page can be divided into 5 sections:

- Request status

- Year switcher

- Notices from SmartHR

- Re-sync account info

- Notices from the administrator (only displayed if configured)

画像を表示する

画像を表示する

1. Request status(依頼状況)

From the request status field, you can check status of your year-end adjustment, see what original document copies that need to be submitted, and preview the year-end adjustment documents that have been created.

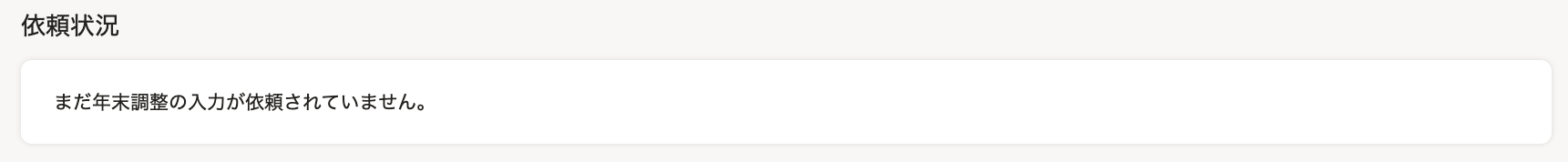

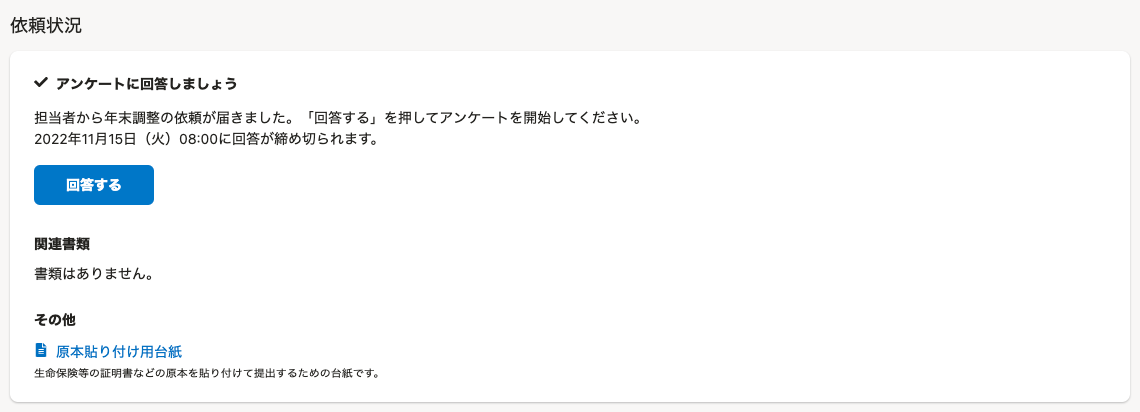

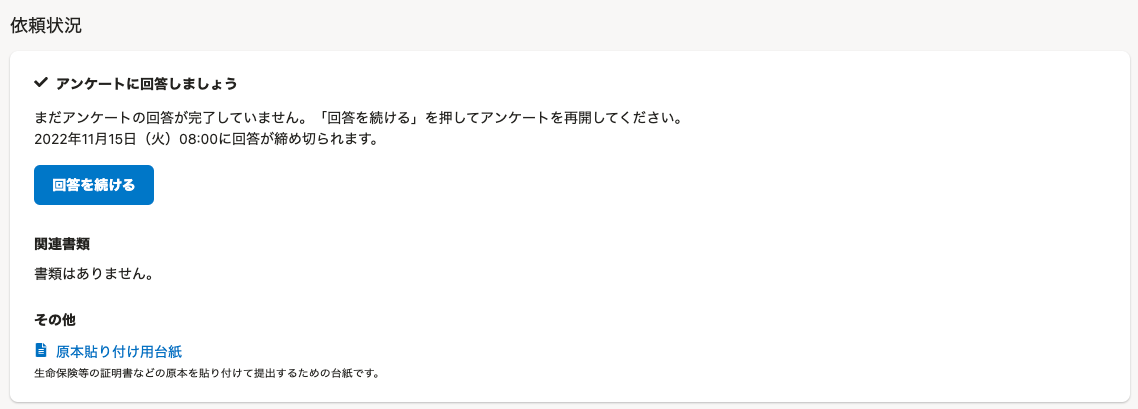

The request status changes as shown below depending on the progress:

(*) Click on an image in the Screenshot column to enlarge it.

| Request status(依頼状況) | Screenshot | Explanation |

|---|---|---|

| You have not yet received a request to fill out your year-end adjustment |  画像を表示する 画像を表示する | Please wait until you receive a request from the administrator (HR staff). Q&A What if I receive a year-end adjustment request email, or the administrator says they requested it, but I don’t see anything here? - Try pressing [Re-sync account info] (アカウント情報再取得) as detailed in section 4 of this article. If you still don’t see an [Answer] button, please check with the administrator (HR staff). |

| A request for year-end tax adjustment has arrived (not opened) |  画像を表示する 画像を表示する | You have received a request to fill out your year-end adjustment survey from the administrator. Press [Answer] to begin answering the survey. |

| A request for year-end tax adjustment has arrived (in progress) |  画像を表示する 画像を表示する | This status will appear if you have answered at least one question in the year-end adjustment survey. Please complete the year-end adjustment survey. |

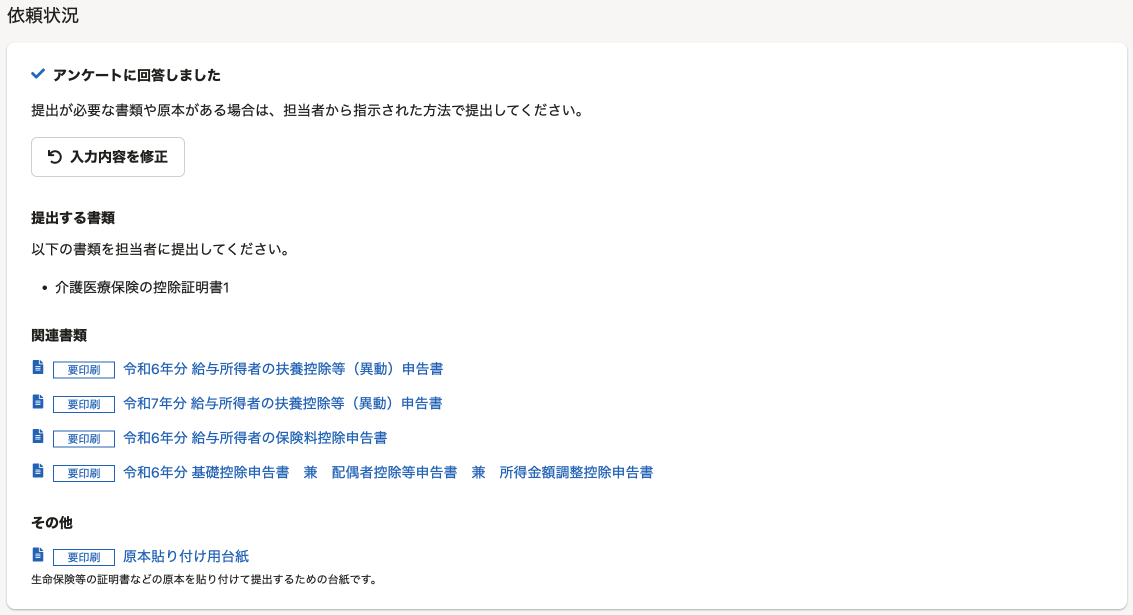

| Completed the year-end adjustment |  画像を表示する 画像を表示する | You have completed the year-end adjustment survey. You can still edit your answers by pressing [Edit my answers]. [Documents to be submitted] section shows you the documents that need to be submitted as an original copy. You can view the documents that were created based on your answers in the [Related documents] section. If the label [Must print] is displayed in front of the document name, this document must be printed and submitted to the administrator (HR staff). If the "Sheet for affixing original copies of certificates for life insurance" (原本貼り付け用台紙) is displayed under [Other], attach the original copies to that sheet and submit them to the administrator (HR staff). |

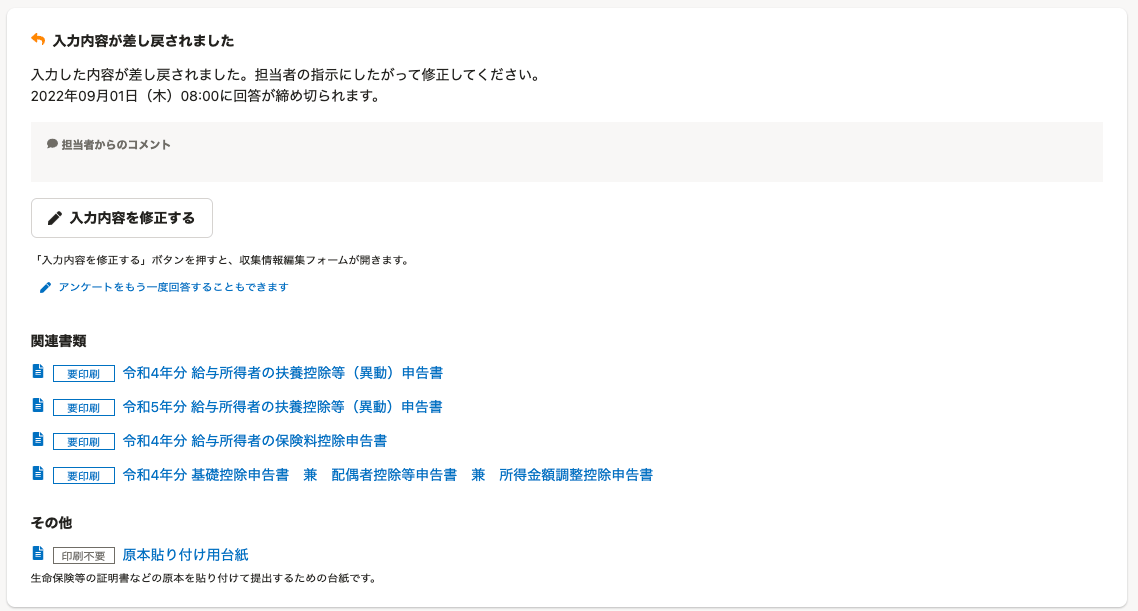

| The year-end adjustment was sent back (a correction was requested) |  画像を表示する 画像を表示する | The administrator sent your year-end adjustment back to you for correction. Press [Edit my answers] (入力内容を修正する) to correct it. If there are any comments from the person in charge, they will be displayed in [Comment from the administrator]. Note: You can also restart the survey from the beginning by pressing [You can also reanswer the survey from the beginning (press here)] (アンケートをもう一度回答することもできます). IMPORTANT If you restart the survey from the beginning, all information related to the housing loan will be deleted. You will need to enter this information once again. All other information will be saved from the previous time you filled out the survey, so you do not need to re-enter anything. Please note that any year-end adjustment documents previously created will also be deleted once you start re-answering. In general, we do not recommend using this unless specifically told to do so by the administrator. |

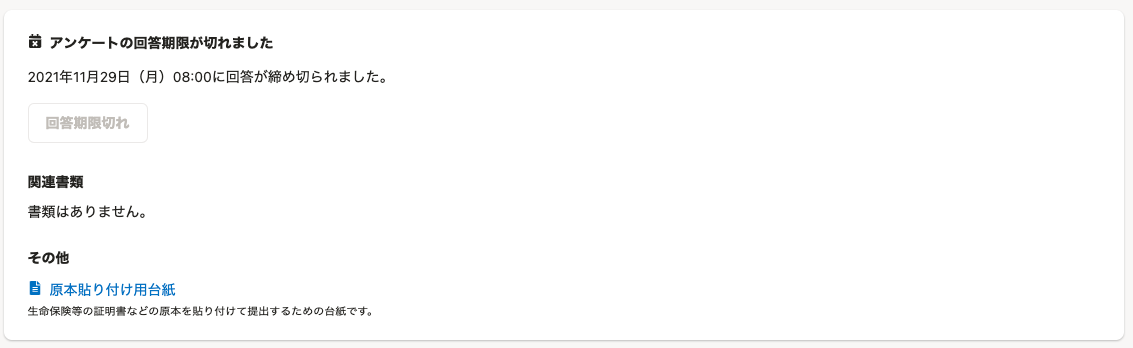

| The request for year-end adjustment has expired. |  画像を表示する 画像を表示する | Your year-end tax adjustment is past the deadline. You can no longer complete your year-end adjustment, even if you have already started it (but have not submitted it). However, if you received a request for corrections, you can still make those corrections. |

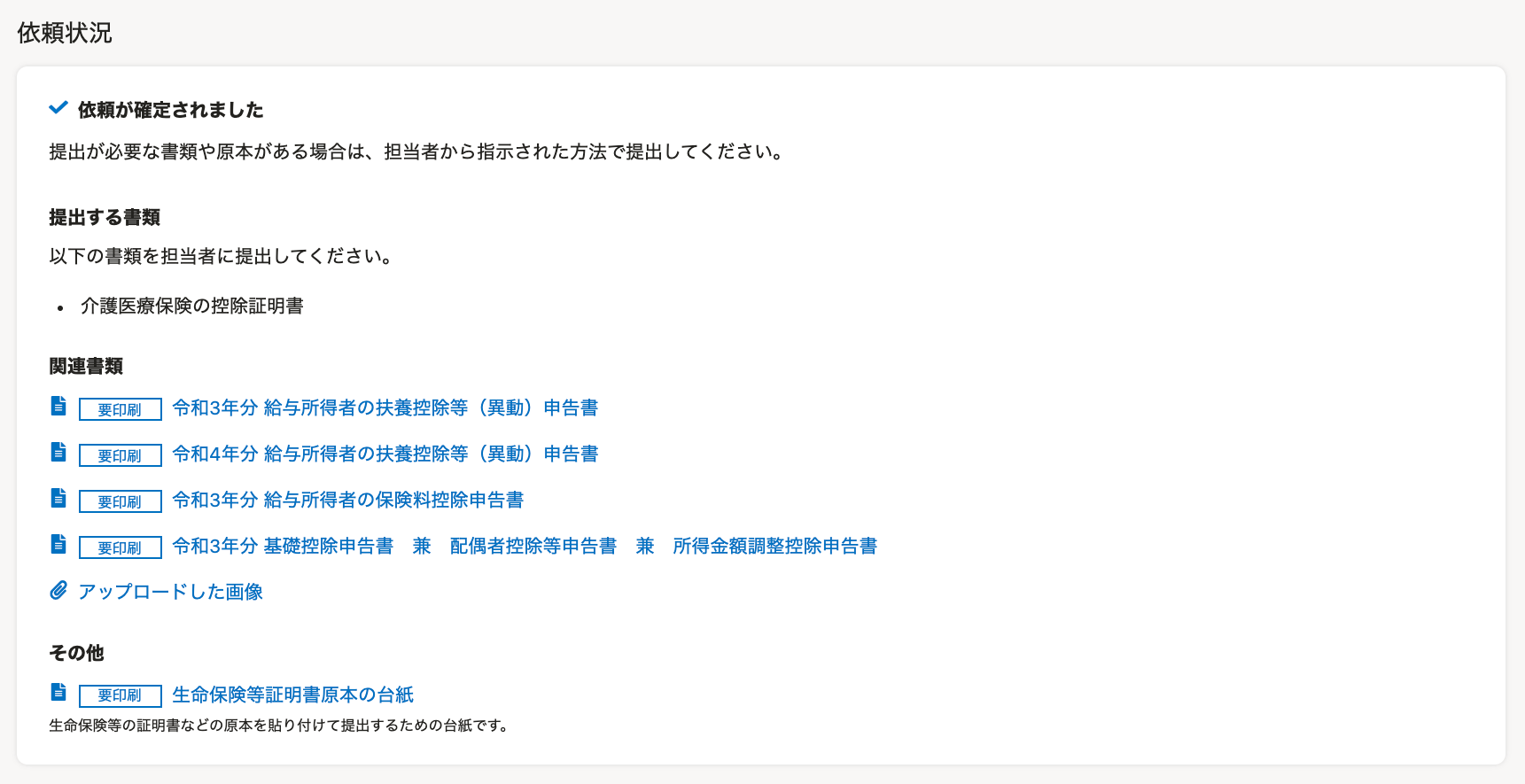

| Year-end adjustment has been finalized |  画像を表示する 画像を表示する | Your year-end adjustment has been finalized. If any documents or original copies of a form needs to be submitted, lease follow the instructions from the administrator (HR staff). |

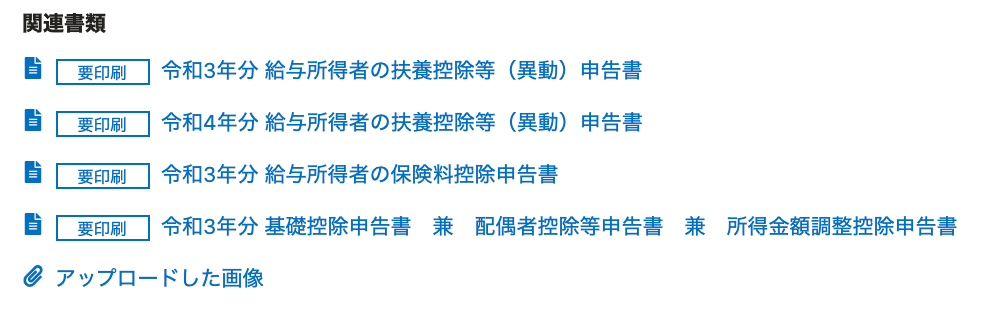

Related Documents

After completing the year-end adjustment survey, the names of documents that were created will be displayed in the related documents section.

画像を表示する

画像を表示する

Press any document name to preview it. You can also download and print out the document from the preview page.

Press any uploaded image to preview the image that you attached when answering the year-end adjustment survey.

Other

The [Other] section is only displayed when the administrator enables the "Use the sheet for affixing document originals" option for the year-end adjustment feature.

If Sheet for affixing document originals (原本貼り付け用台紙) is displayed, attach the original copies to the sheet and submit them.

画像を表示する

画像を表示する

2. Year switcher

Press [20xx Year-End Adjustment ▼] to switch to past year-end adjustments (only available if you have submitted them via SmartHR).

3. Notices from SmartHR (SmartHRからのお知らせ)

This appears when there are updates or maintenance announcements for the year-end adjustment feature.

Click [List of Notices] (お知らせ一覧) to see the full list of notices from SmartHR.

画像を表示する

画像を表示する

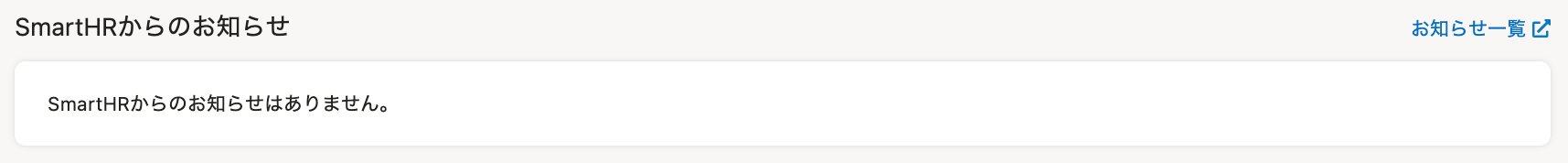

4. Re-sync account info (アカウント情報再取得)

This function is for people who have been using SmartHR with multiple companies.

Press [Re-sync account info] and you will see a confirmation screen. If the company you are multi-logged in to does not change automatically, this function will switch it manually.

画像を表示する

画像を表示する

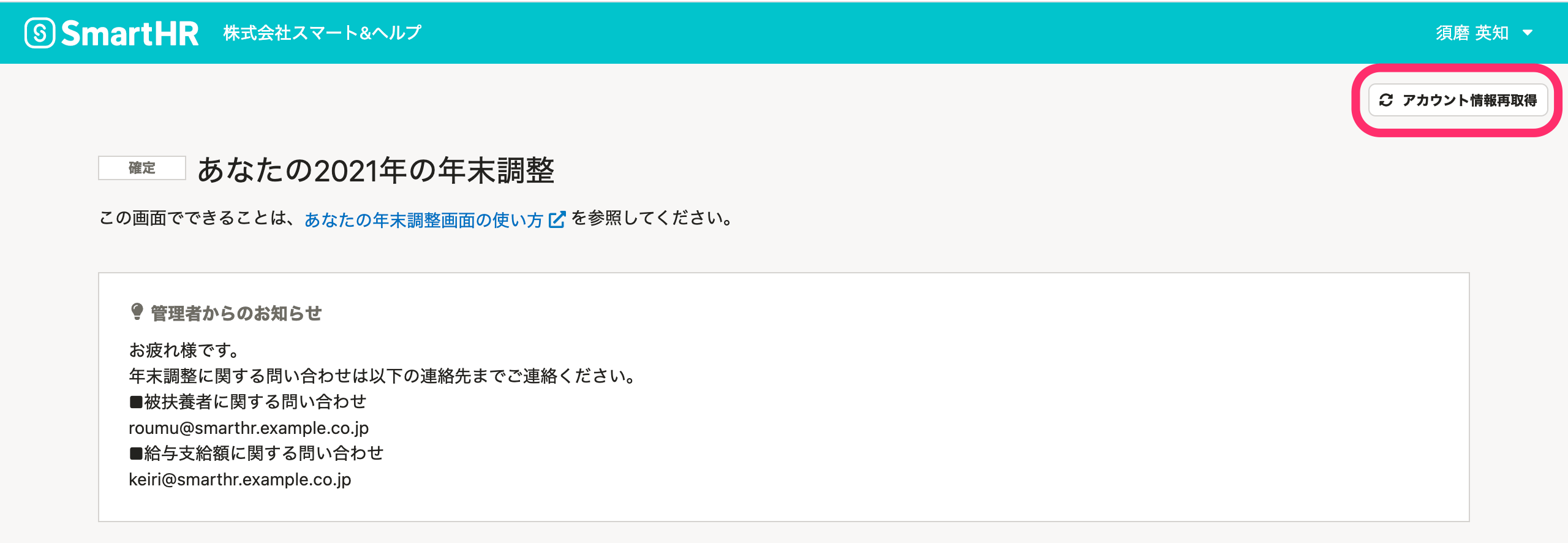

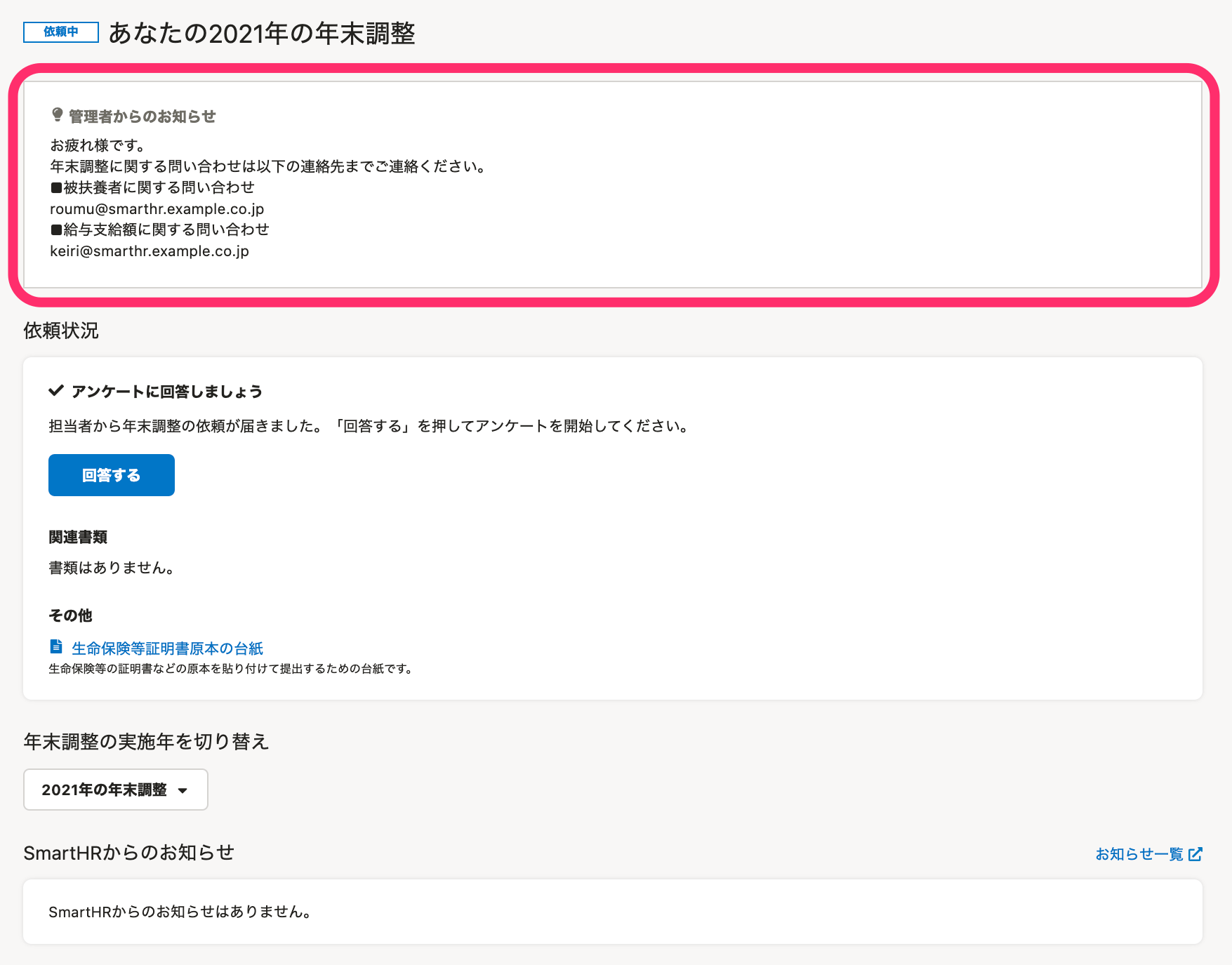

5. Notices from the administrator (管理者からのお知らせ)

[Notices from the administrator] displays announcements from your company’s HR staff concerning the year-end adjustment, such as information about the employee help desk and submission deadlines for original documents.

This might not be displayed if the administrator has not enabled it in settings.

画像を表示する

画像を表示する