Employee Guide: Year-End Adjustment Process on PC

- For:

- Employees

- Plans:

- Simple HRHR Essentials0 YenHR Strategy

This guide explains the year-end adjustment process (for employees) on a PC, from receiving the request to completing the survey and submitting the required documents to HR. For the explanation of the process on smartphones, see Employee Guide: Year-End Adjustment Process on Smartphones.

- 1. Open SmartHR using the link from the email with the year-end adjustment request

- 2. Press [Answer] to begin the year-end adjustment

- 3. Answer the questionnaire

- 4. Check the information you entered

- 5. Check your application forms

- 6. Return to the home screen

- 7. Prepare and submit the required documents

- Need help?

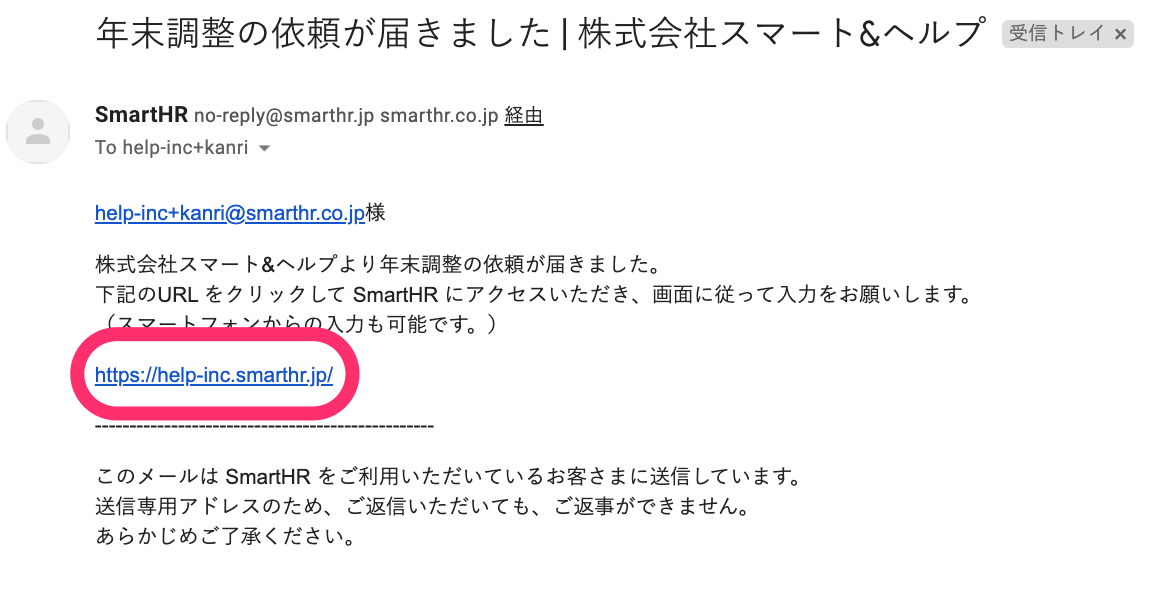

1. Open SmartHR using the link from the email with the year-end adjustment request

Find an email titled [年末調整の依頼が届きました] (“year-end adjustment request received”) and press the link inside to access SmartHR.

画像を表示する

画像を表示する

Enter your employee number or email address and password on the login screen and press [Log in].

Refer to the following help pages if you need additional guidance (forgot password, unable to log in, etc.):

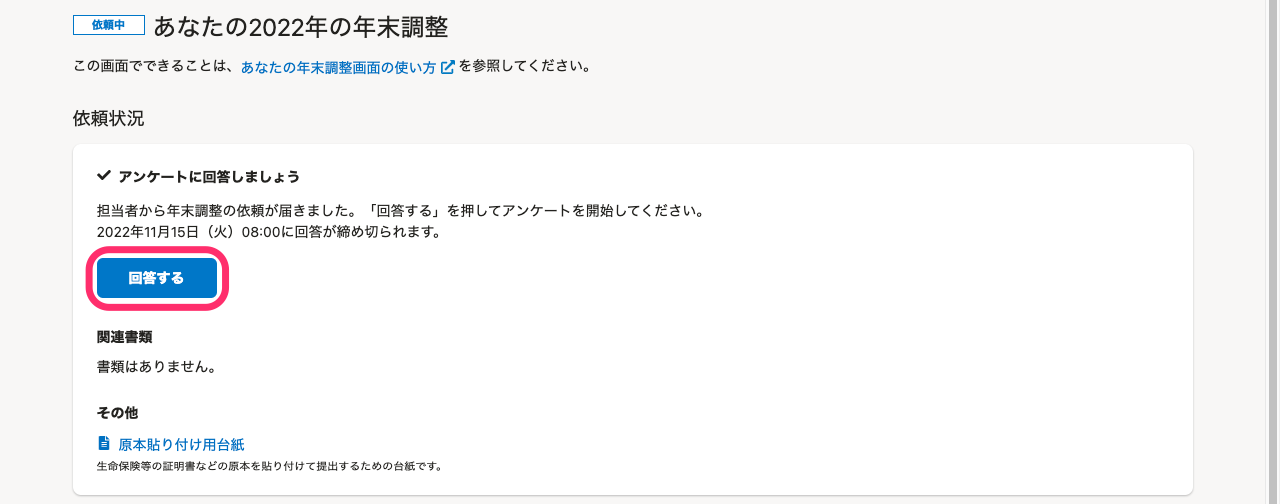

2. Press [Answer] to begin the year-end adjustment

Press [Answer] to open Question 1 of the year-end adjustment.

画像を表示する

画像を表示する

Question 1 explains how to pause the questionnaire, which documents you’ll need, and how long it takes. Please read this page carefully before proceeding.

At the bottom of the page, press [Start] to begin answering.

画像を表示する

画像を表示する

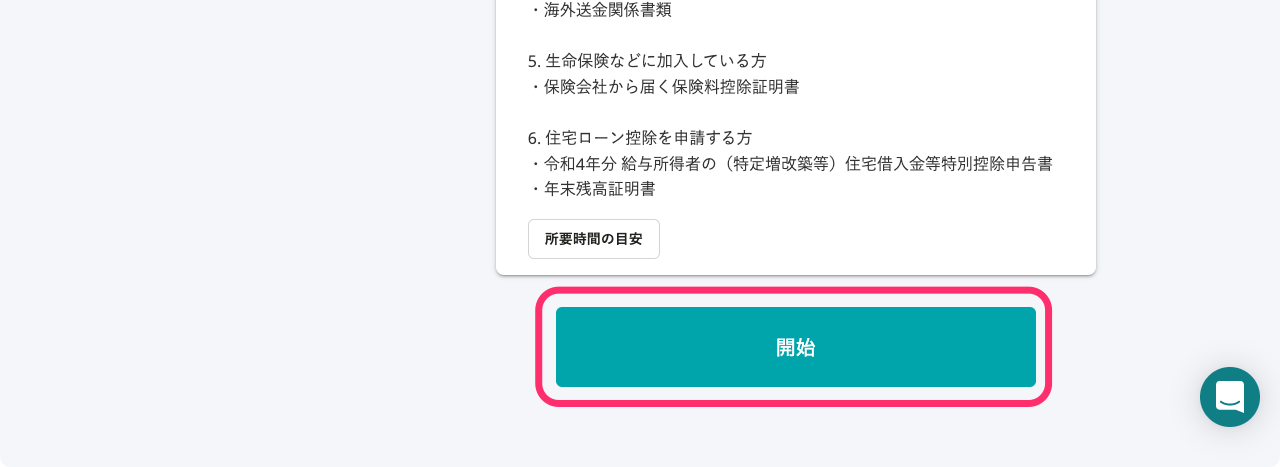

3. Answer the questionnaire

Read each question and select the answers that apply to your situation.

If you want to redo your answers

If you selected the wrong option, you can redo it by clicking the blue link in the Answer History on the left side of the screen.

画像を表示する

画像を表示する

If you accidentally deleted your entries

If you deleted pre-filled information by mistake, reload the page or click the previous question in the answer history and start again. Once you move to the next question with deleted data, it can’t be restored. If that happens, please re-enter the information that was deleted.

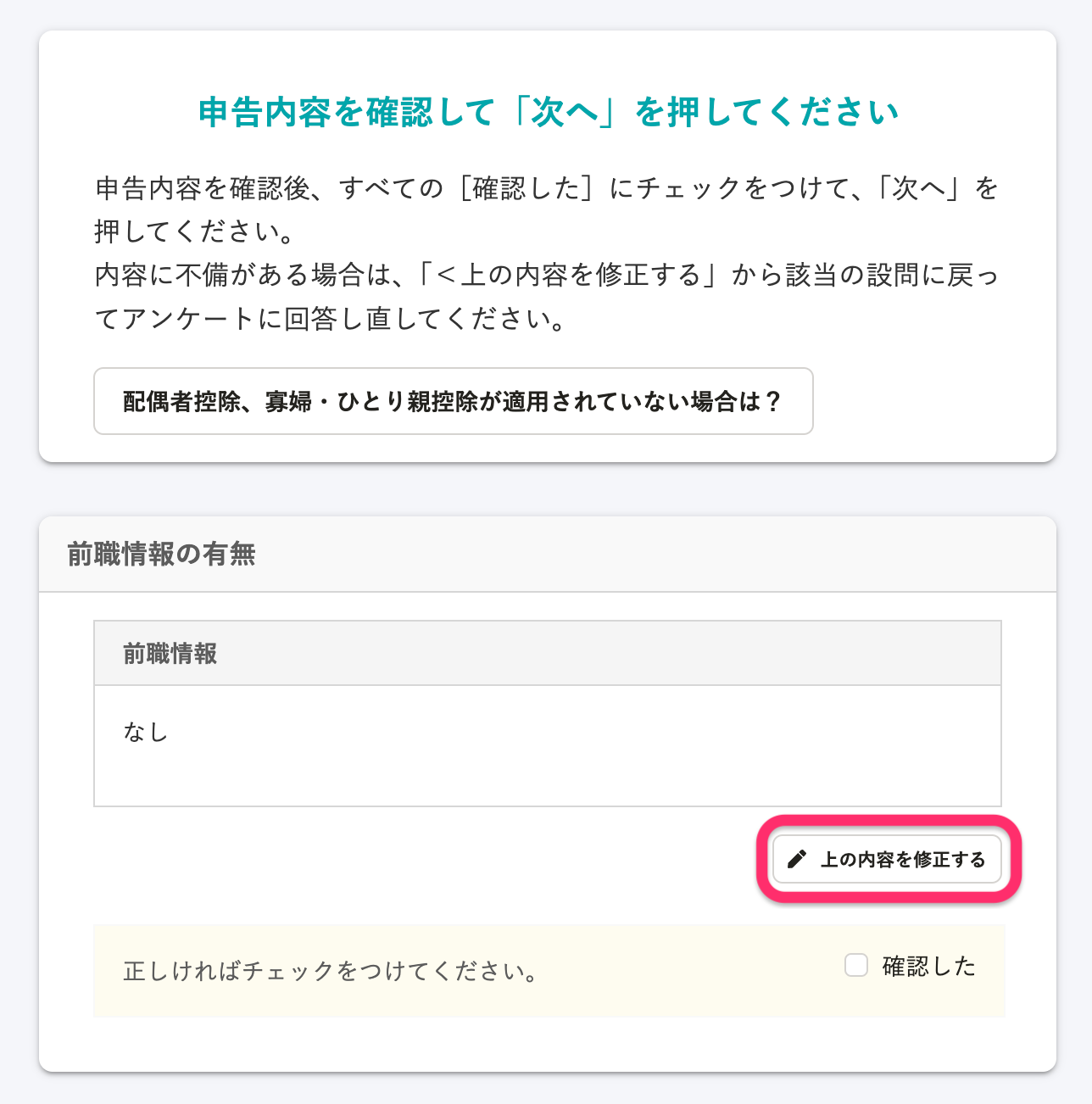

4. Check the information you entered

During the questionnaire, you’ll see review screens showing what you’ve entered so far.

If you need to make corrections, press [Edit the above]. If everything is correct, check [I confirm that this information is correct] for all items, then proceed to the next question.

画像を表示する

画像を表示する

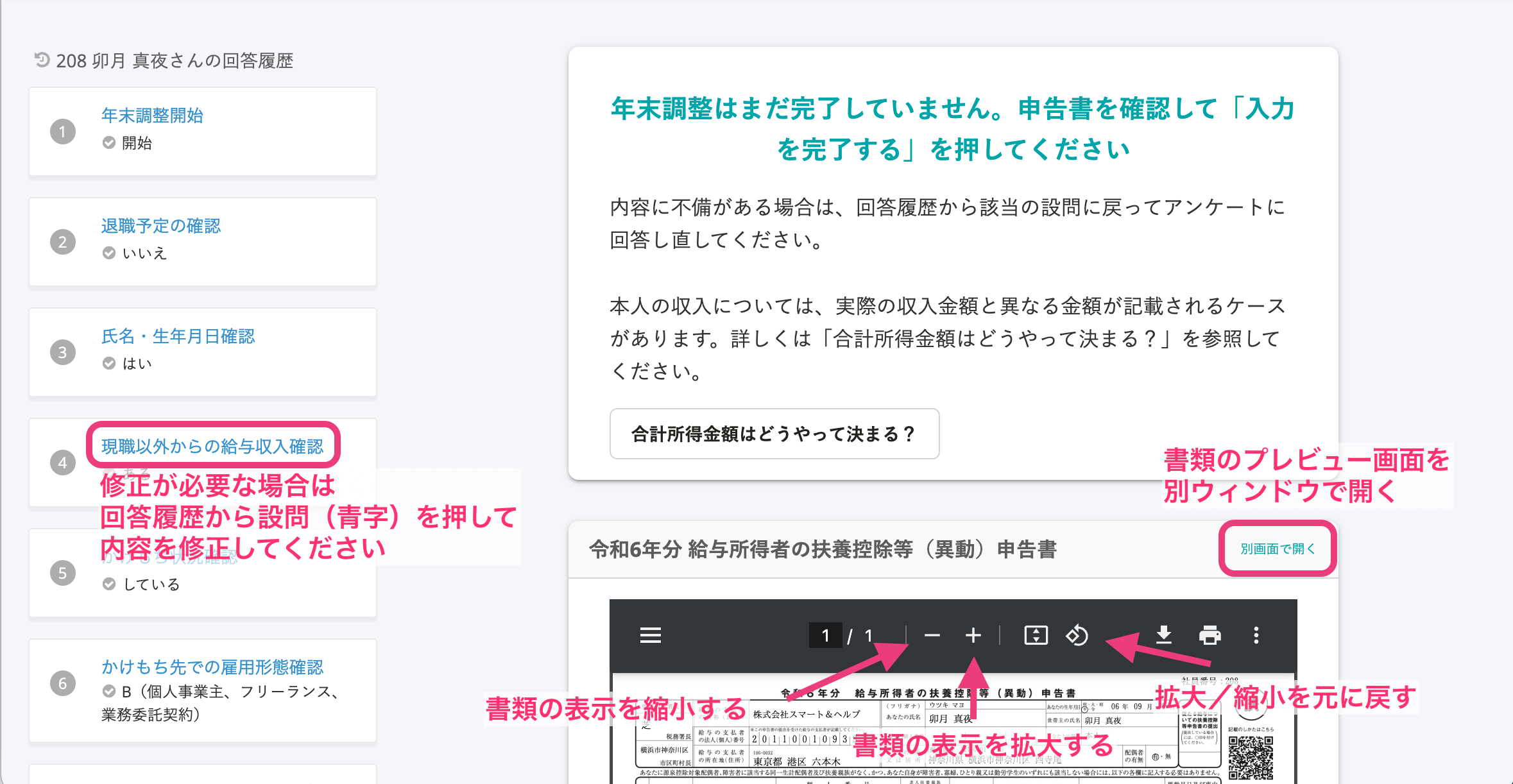

5. Check your application forms

SmartHR automatically generates the year-end adjustment forms based on your answers.

Review the forms on the preview screen. If you need to make corrections, select the blue link from the answer history on the left to go back and edit. On the form preview screen, you can zoom in or out, and select [Open in new tab] to view the document full-screen.

If everything looks correct, select [Complete entering information] at the bottom. The completion screen will appear.

画像を表示する

画像を表示する

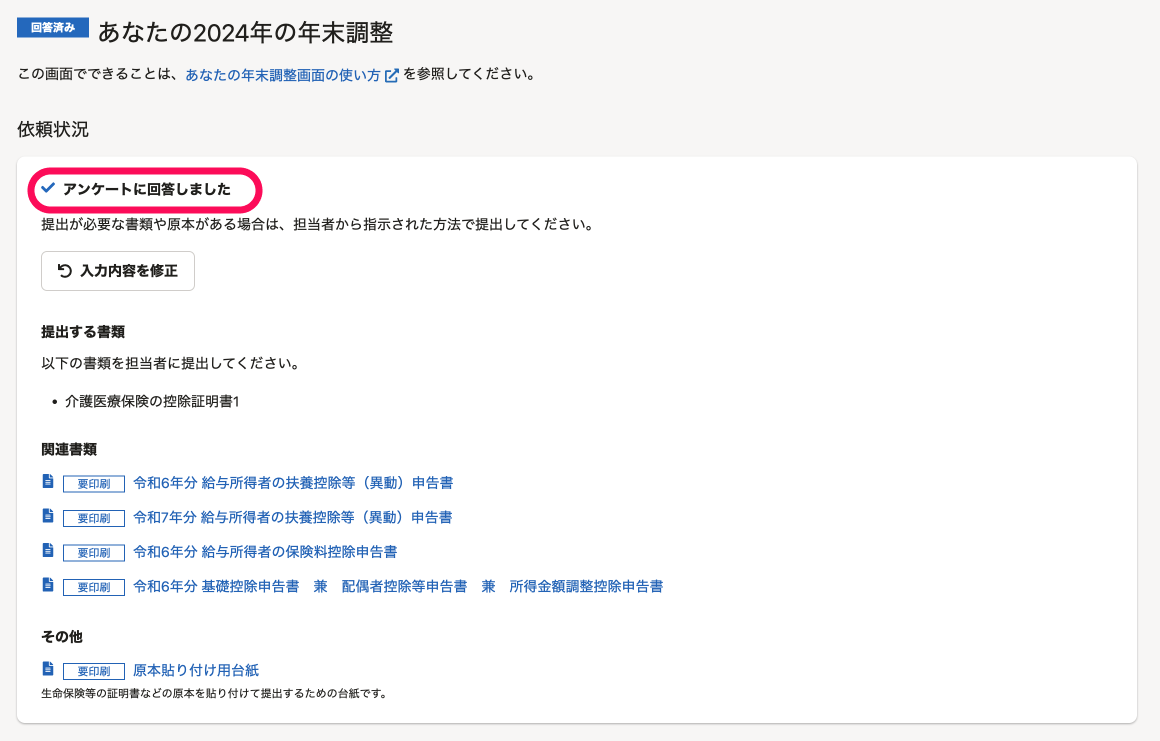

6. Return to the home screen

On the completion screen, select [Return to the year-end adjustment home screen]. Your year-end adjustment page will now show The survey has been answered. You can review the generated documents there.

画像を表示する

画像を表示する

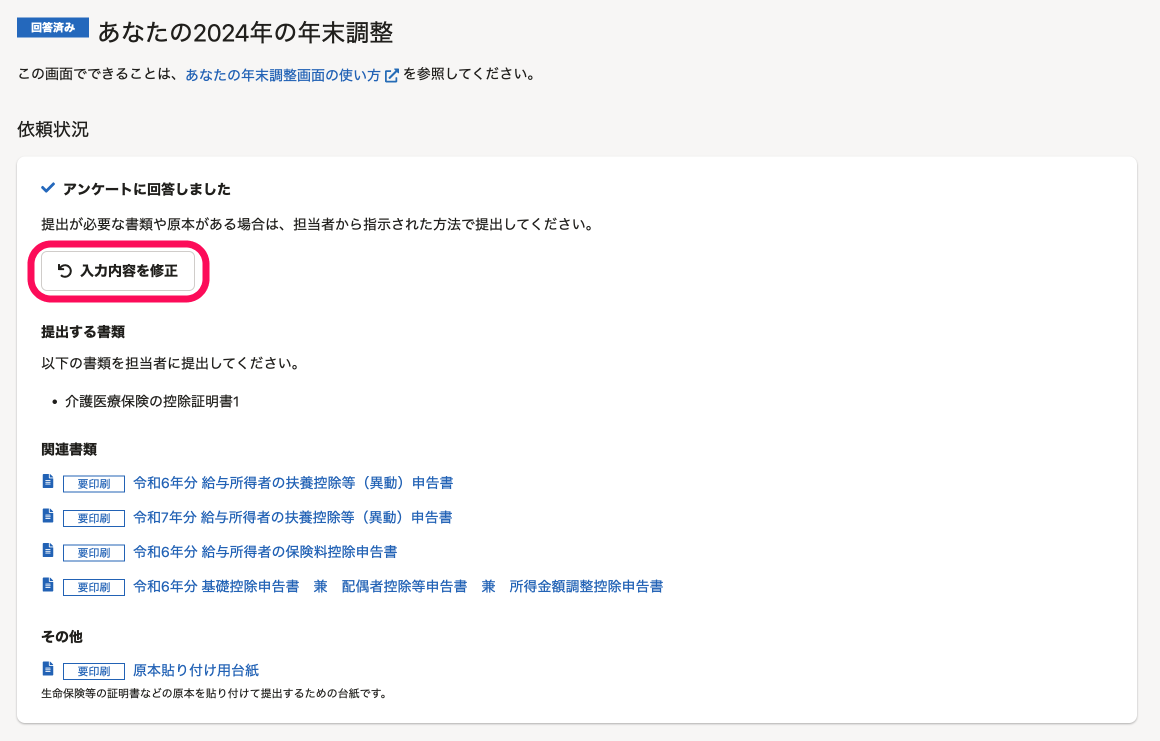

If you need to make corrections

You can edit your answers as long as the administrator hasn’t reviewed them yet. Press [Edit my answers] to open the editing page.

画像を表示する

画像を表示する

Select the item you want to correct from Select items to edit, enter the reason for correction, and press [Edit] . Make the necessary changes and save them by pressing [Save and Submit].

7. Prepare and submit the required documents

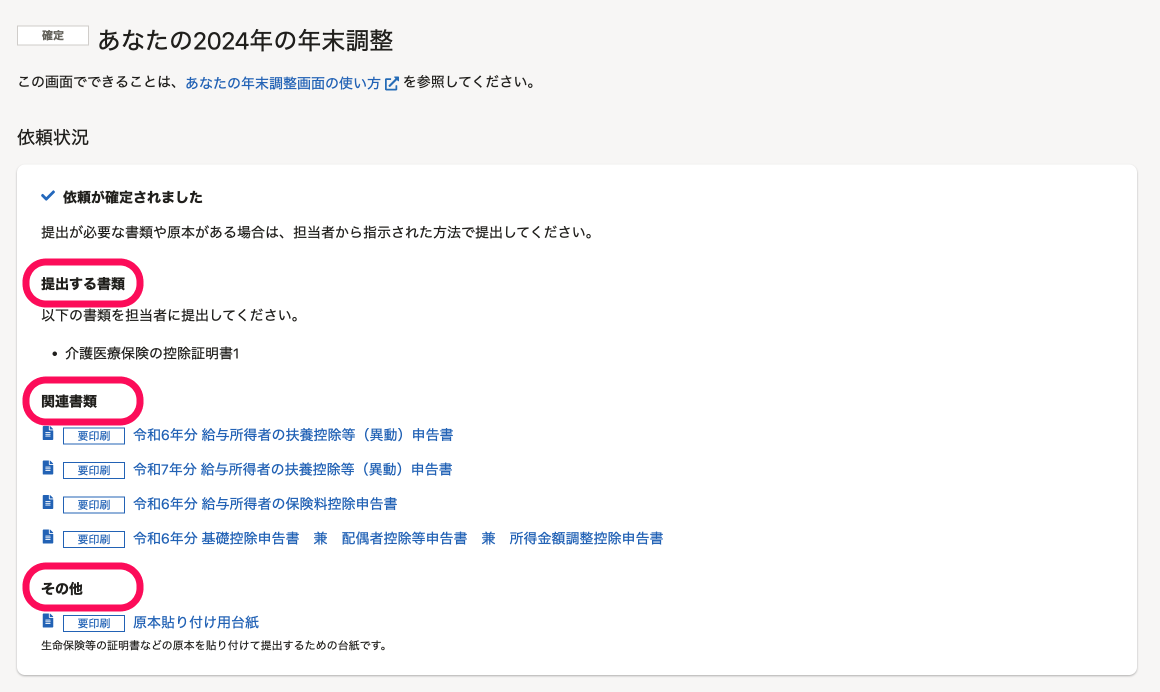

Read through the sections [Document(s) to submit] and [Related documents], then print out the necessary documents and submit them to the HR staff of your company, if required. Documents labeled as [Must print] must be printed out and submitted to the HR.

The [Other] section may include the [Sheet for affixing document originals] if your company uses such sheets for attaching original certificates. Attach the originals (such as insurance or housing loan certificates) to the sheet before submitting. If you need multiple sheets, follow your HR staff’s instructions for combining and submitting them.

画像を表示する

画像を表示する

Need help?

Check the help pages under: Year-end adjustment. Our Help Center has articles addressing frequently asked questions from employees.