Basic information and FAQ about year-end adjustments

- For:

- Employees

- Plans:

- Simple HRHR Essentials0 YenHR Strategy

This page provides basic knowledge about year-end adjustment and introduces frequently asked questions from all employees.

What is year-end adjustment?

It adjusts any excess or deficiency for withholding income tax on the salary paid to an employee in one year from January to December.

The amount of income tax that needs to be paid for the year cannot be calculated until the employee’s annual income has been confirmed. Therefore, a “temporary income tax amount” is subtracted from the employee’s salary each month based on their amount of income and number of dependents. An accurate amount of income tax is then calculated at the end of the year and if the employee has paid too much, they receive a tax refund. If the employee has not paid enough, they will have to pay additional tax.

Advantages of using SmartHR for year-end adjustment

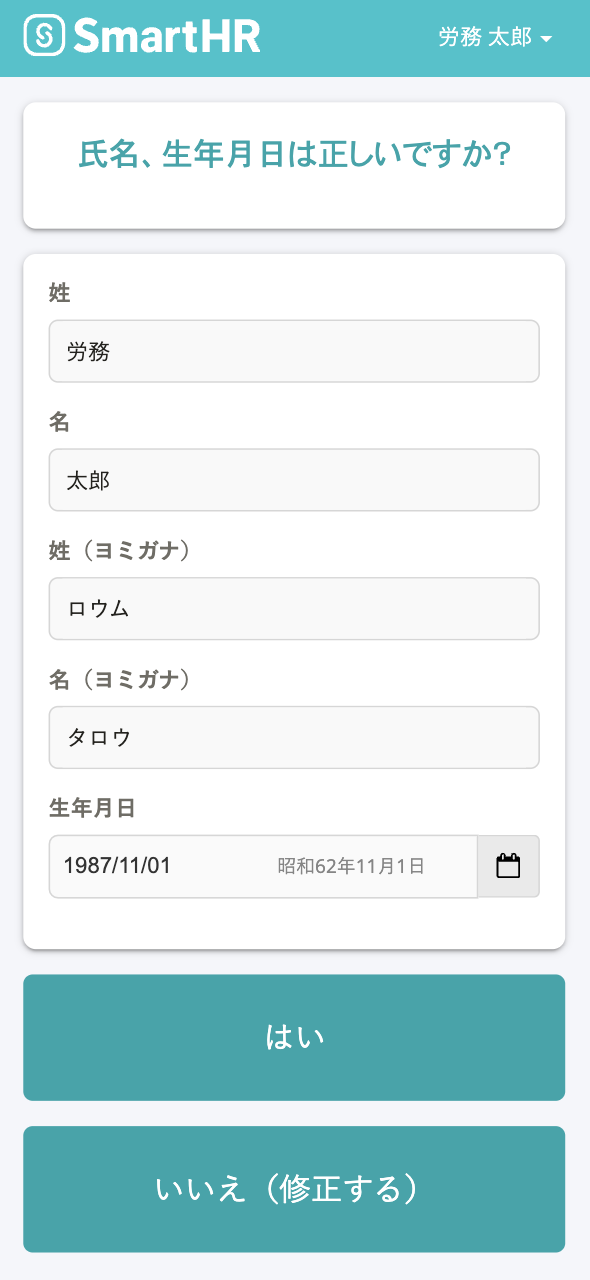

Using the SmartHR year-end adjustment function enables you to create the necessary deductions application forms simply by answering the questions (in the survey) using a computer or smartphone. The deductions application forms can be submitted electronically. Since basic information such as your address has already been entered as information registered with the SmartHR basic function, there is no need to enter this information again from the beginning.

画像を表示する

画像を表示する

For details about the procedure to answer the survey, see the help pages below.

- Employee Guide: Year-End Adjustment Process on PC

- Employee Guide: Year-End Adjustment Process on Smartphones

Year-End Tax Adjustment is also available in languages other than Japanese

The Year-End Tax Adjustment questionnaire is available in languages other than Japanese, as well as “Easy Japanese”. It helps employees with diverse needs, including non-native Japanese speakers, people with reading difficulties, older adults, and people with disabilities, submit their year-end adjustment without major issues.

Frequently Asked Questions

Q. What will happen if I do not perform the year-end adjustment?

A. You will have to file a final tax return (確定申告) by yourself.

It will be necessary to create the final tax return form by yourself and then send it to your local tax office. If you don’t adjust your income tax through year-end adjustment or a final tax return, you may miss a refund for overpaid taxes, or forget to pay additional taxes that you still owe. Creating the final tax return form tends to be more complicated than the year-end adjustment procedure. Be sure to perform the year-end adjustment so that you do not fail to pay your taxes.

Q. I intend to file a final tax return, so do I need to perform the year-end adjustment?

A. Yes, you need to perform the year-end adjustment.

Even if you will file a final tax return in order to receive deductions such as medical expense deductions, or due to having additional income, you will need to perform the year-end adjustment. All employees except those to which any of the following conditions apply are required by law to perform the year-end adjustment (Article 190 of the Income Tax Act).

- Total employment income for a year exceeds 20 million yen

- The employee deferred payment or received a refund of withholding tax for the income tax or special income tax for reconstruction on their salary in that year based on the provisions of the Disaster Exemption Act

Who needs to perform the year-end tax adjustment | National Tax Agency別タブで開く

Even if you complete both a year-end adjustment and a final tax return, your taxes and deductions won’t be applied twice.