Conditions for Displaying Deductions on Year-End Adjustment Forms

- Readership:

- AdministratorsEmployees

- Plans:

- Simple HRHR Essentials0 YenHR Strategy

The following are the conditions for deduction claims to appear on employees' year-end adjustment forms.

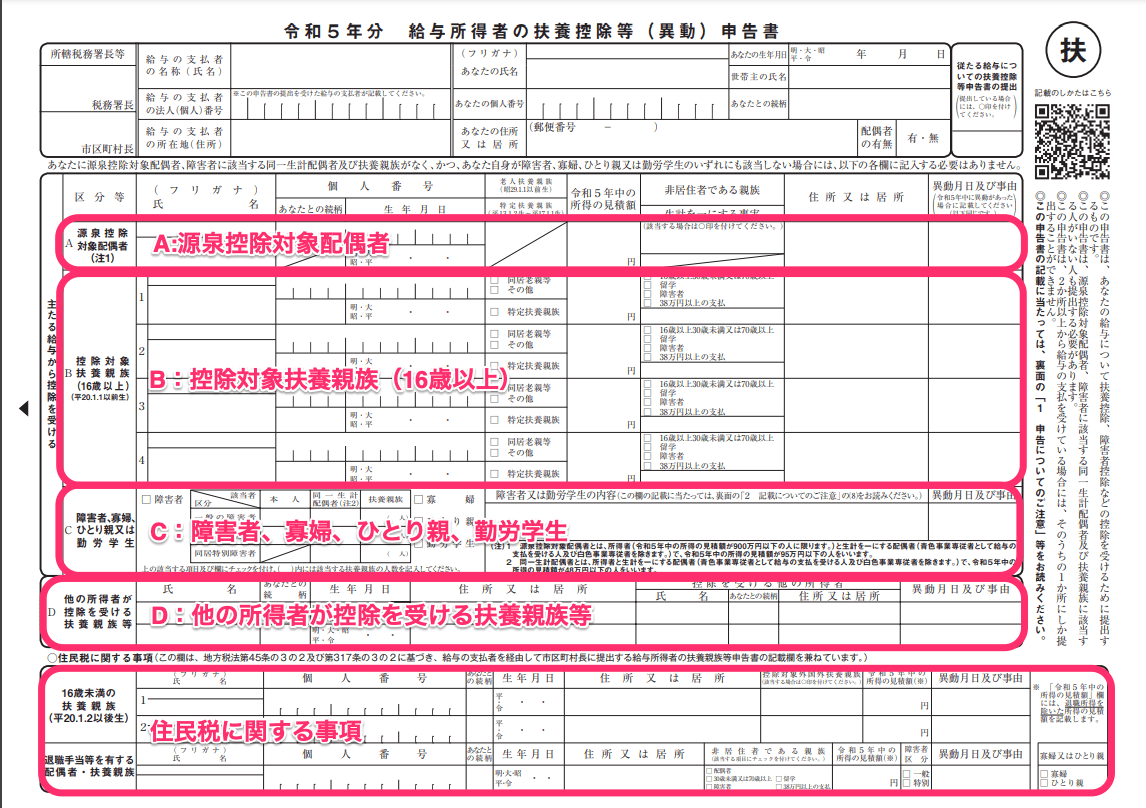

- Application for Exemption for Dependents of Employment Income Earner (給与所得者の扶養控除等申告書)

- A: Conditions for listing a spouse who qualifies for tax deduction at the source (源泉控除対象配偶者)

- B: Conditions for listing dependent relatives qualified for deductions (aged 16 or older)

- C: Conditions to display a person with disabilities, widow, single parent, or working student

- D: A dependent relative of an income earner other than the employee

- Matters related to inhabitant tax (住民税)

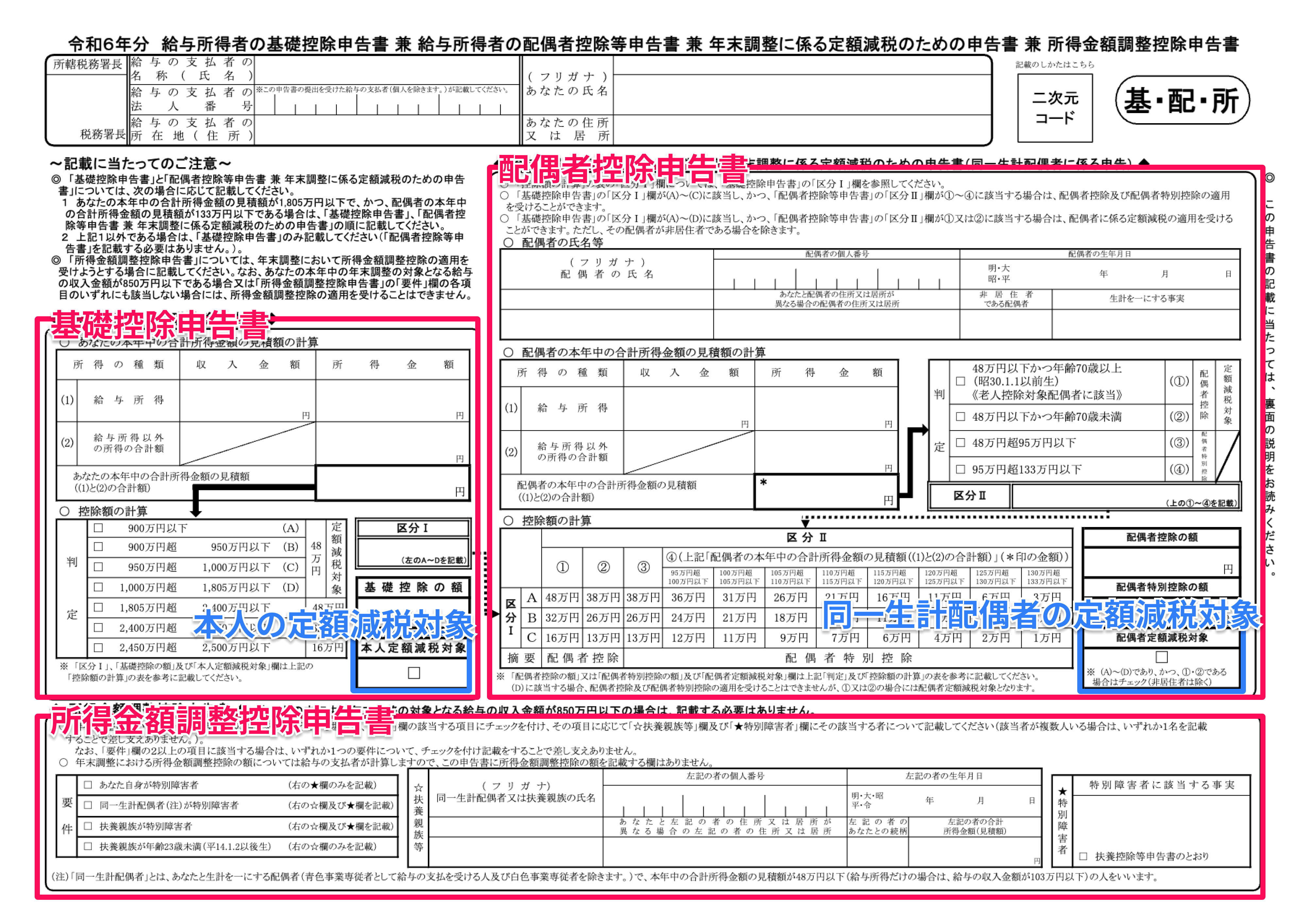

- Application for Basic Exemption of Employment Income Earner and Application for Exemption for Spouse of Employment Income Earner and Application for Exemption of Amount of Income Adjustment (給与所得者の基礎控除申告書 兼 給与所得者の配偶者控除等申告書 兼 年末調整に係る定額減税のための申告書 兼 所得金額調整控除申告書).

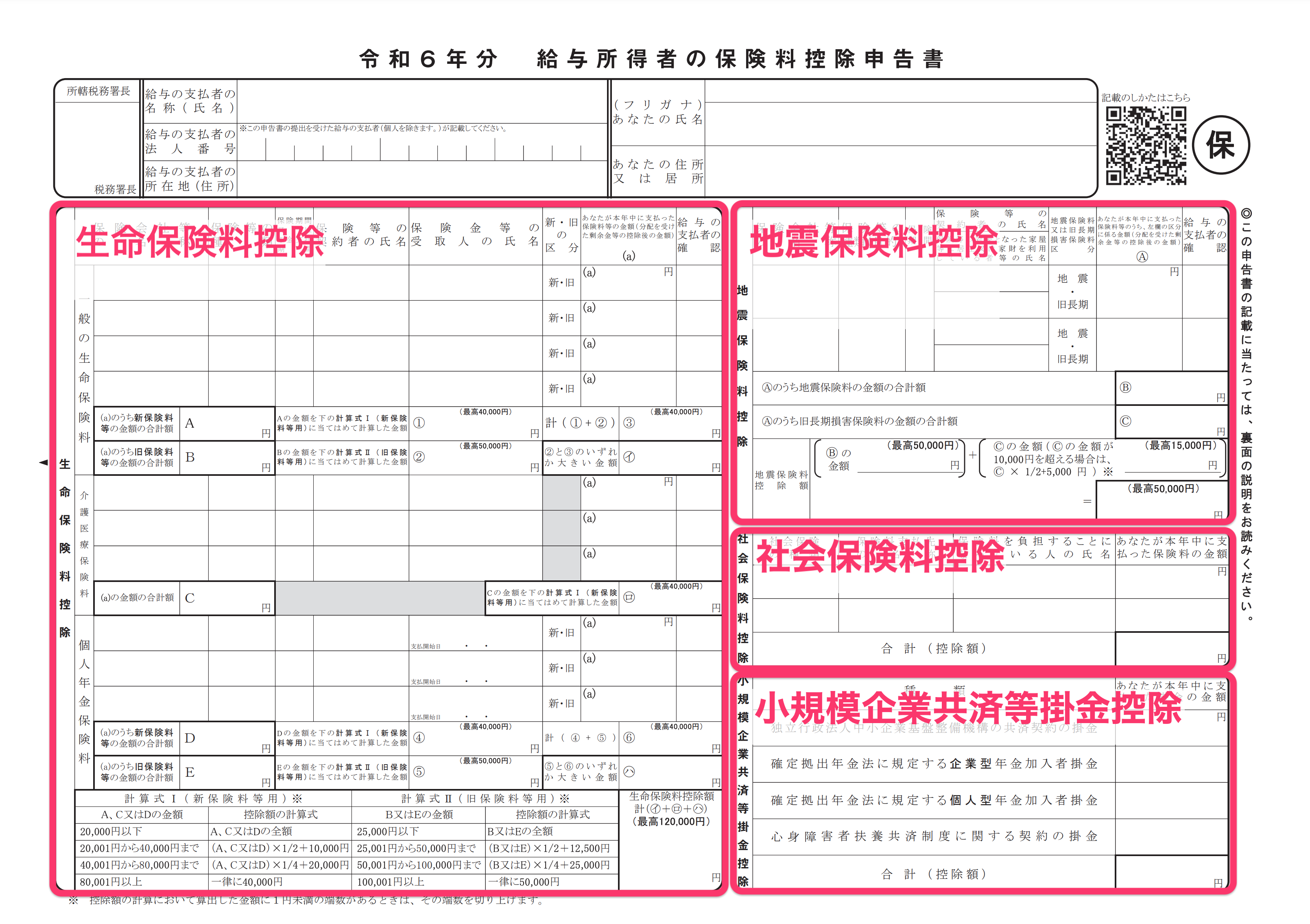

- Application for Deduction for Insurance Premiums for Employment Income Earner (給与所得者の保険料控除等申告書)

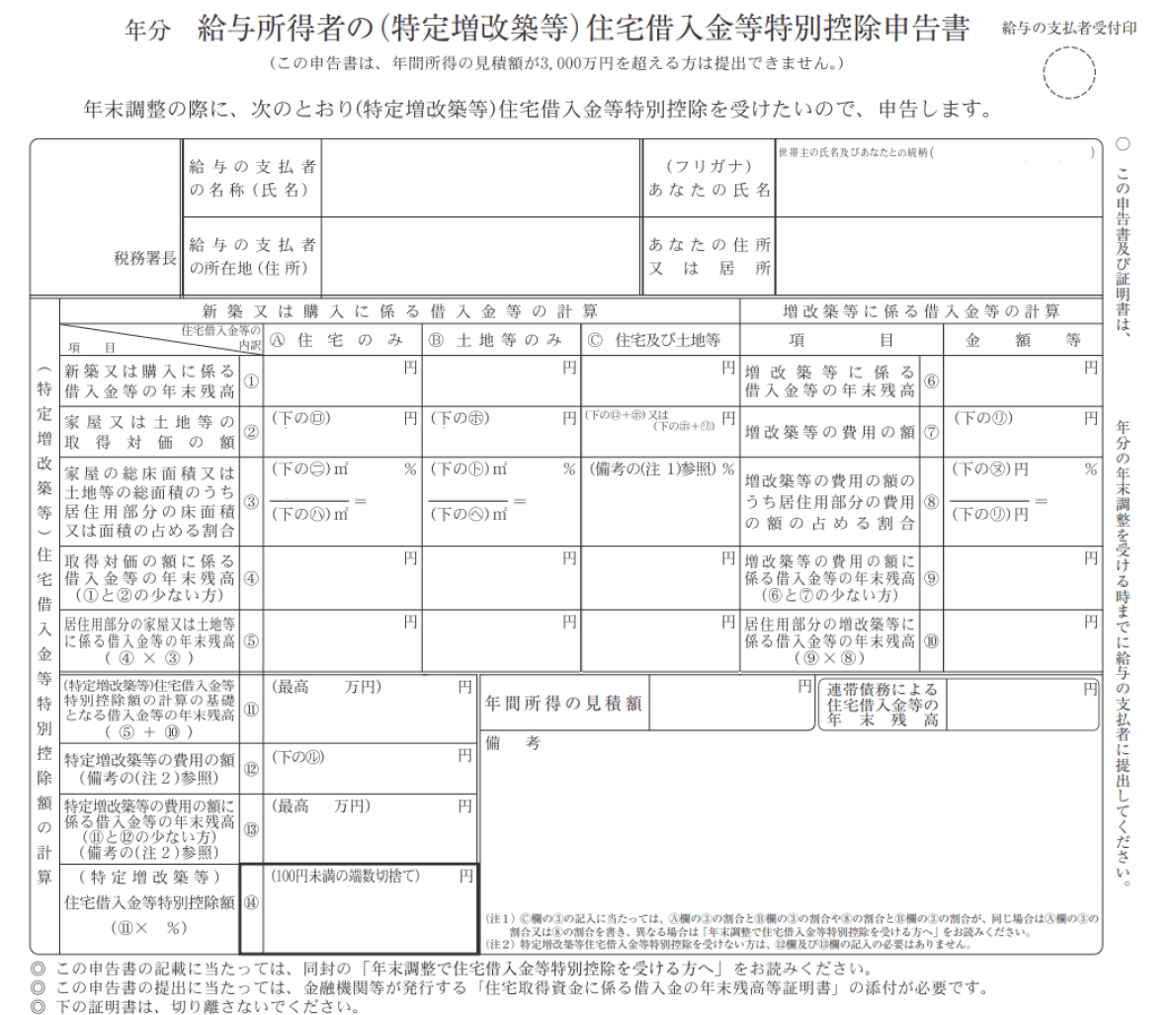

- Application for Special Credit for Loans Related to a Dwelling (Specific Additions or Improvements) for Employment Income Earner (Form for those who started residing by 2018) (給与所得者の(特定増改築等)住宅借入金等特別控除申告書)

- Application for Special Credit for Loans Related to a Dwelling (Specific Additions or Improvements) for Employment Income Earner and Detailed Statement and Calculation Form for Special Credit for Loans (Form for those who began residing between 2019 and 2021) (給与所得者の(特定増改築等)住宅借入金等特別控除申告書 兼 (特定増改築等)住宅借入金等特別控除計算明細書)

- Application for Special Credit for Loans Related to a Dwelling (Specific Additions or Improvements) for Employment Income Earner and Detailed Statement and Calculation Form for Special Credit for Loans (Form for those who began residing in or after 2022) (給与所得者の(特定増改築等)住宅借入金等特別控除申告書 兼 (特定増改築等)住宅借入金等特別控除計算明細書)

Application for Exemption for Dependents of Employment Income Earner (給与所得者の扶養控除等申告書)

画像を表示する

画像を表示する

A: Conditions for listing a spouse who qualifies for tax deduction at the source (源泉控除対象配偶者)

- Answered "Yes" to having a spouse or "My spouse passed away this year" in the year-end adjustment survey

- Employment income is 10.95 million yen or less (= earnings of 9 million yen or less)

- Spouse's employment income is 1.5 million yen or less (= earnings of 950,000 yen or less)

- (For 2024) Answered “This year” in “Years your spouse has been your dependent”

- (For 2025) Answered “Next year” in “Years your spouse has been your dependent”

Whether your spouse is a dependent under Japanese tax law is determined based on what is displayed in this field.

If you do not meet these income (earnings) requirements, you will not be eligible for this deduction and it will not be displayed on the document.

B: Conditions for listing dependent relatives qualified for deductions (aged 16 or older)

- Information for dependent relatives is entered in the year-end adjustment survey

- Employment income of dependent relative is 1.03 million yen or less (= earnings of 480,000 yen or less)

- Date of birth for dependent relative is on or before January 1, 2009

A non-resident of Japan (relative living abroad) who is between the ages of 30 and 70 (born on or after January 2, 1955 but on or before January 1, 1995) must meet one of the following requirements.

- They do not live in Japan due to studying abroad

- They are a person with general disabilities

- They receive a remittance of 380,000 yen or more

Conditions for listing elderly dependent relatives and specified dependent relatives

- An elderly dependent relative is determined to be an “Elderly parent or grandparent who lives with you” (同居老親等) if they are living together with you, were born on or before January 1, 1955, and are your or your spouse’s direct ascendant.

- An elderly dependent relative is categorized as “Other” (その他) if they are not living together with you or are not a direct ascendant of you or your spouse, born on or before January 1, 1955.

- They are determined to be a “Specified dependent relative” (特定扶養親族) if they were born between January 2, 2002 and January 1, 2006

Note that direct ascendants include the following relatives:

- Father, mother, biological father, biological mother, father-in-law, mother-in-law, adoptive father, adoptive mother

- Grandfather, grandmother, grandfather-in-law, grandmother-in-law, adoptive grandfather, adoptive grandmother

- Great-grandfather, great-grandmother, great-grandfather-in-law, great-grandmother-in-law

C: Conditions to display a person with disabilities, widow, single parent, or working student

Disabilities deductions

- Selected disabilities deductions in the year-end adjustment survey

- Entered information required to apply for disabilities deductions

- The condition for a spouse to qualify for the disability deduction is having an income of 480,000 yen or less (for spouses sharing living expenses)

Widow and single parent deductions

Widow deductions

- The person who answered the survey is female

- Answered “No” to the question “Do you have "not officially registered" (未届) listed as the relationship status on your Resident Record?” (住民票の続柄に(未届)の記載はありますか?)

- Total earnings are 5 million yen or less

- Any of the following must be applicable:

- Answered “Yes (divorced)” to the question about past spouses, and registered a dependent relative other than a child in family information

- Answered “Yes (widowed)” to the question about past spouses

- Answered “Yes (spouse whereabouts unknown)” to the question about past spouses

Single parent deductions

- Answered “No” to the question “Do you have "not officially registered" (未届) listed as the relationship status on your Resident Record?” (住民票の続柄に(未届)の記載はありますか?)

- Total earnings are 5 million yen or less

- Answered “No”, “Yes (divorced)”, “Yes (widowed)”, or “Yes (spouse whereabouts unknown)” to the question about past spouses

- Registered a child in family information

Working student

- Applied for working student deductions in the year-end adjustment survey

- Entered information required for working student deductions

- Employment income is 1.3 million yen or less (=earnings of 750,000 yen or less), among which earnings outside of employment do not exceed 100,000 yen

D: A dependent relative of an income earner other than the employee

Our system is configured to display an empty field in the D column if there is a dependent for whom another income earner is claiming a deduction. If they are eligible for earnings amount adjustment deductions (所得金額調整控除), it will be displayed in the “Dependent relatives” (扶養親族等) column of the “Application for Exemption of Amount of Income Adjustment” (所得金額調整控除申告書) form. If it is printed on the “Application for Exemption of Amount of Income Adjustment” form, you can receive the deductions.

Matters related to inhabitant tax (住民税)

Conditions to display dependent relatives under the age of 16

- Entered information for dependents in the year-end adjustment questionnaire

- Employment income of dependent relative is 1.03 million yen or less (= earnings of 480,000 yen or less)

- (For 2024) Date of birth of dependent relative is on or after January 2, 2009

- (For 2025) Date of birth of dependent relative is on or after January 2, 2010

Conditions to display spouse and dependent relatives with resignation allowances

- Entered information on spouse or dependents in the year-end adjustment survey

- Selected “Next year” (来年扶養する) or “Not a dependent” (扶養しない) for the dependent status

- Checked the box that says “No longer a dependent because they received a resignation allowance this year” (今年退職手当を受け取ったことで扶養から外れた場合)

- Entered 1 yen or more in the earnings amount for resignation earnings

Widow or single parent

Met the above “Conditions to display spouse and dependent relatives with resignation allowances” and checked the box for a widow or single parent.

Application for Basic Exemption of Employment Income Earner and Application for Exemption for Spouse of Employment Income Earner and Application for Exemption of Amount of Income Adjustment (給与所得者の基礎控除申告書 兼 給与所得者の配偶者控除等申告書 兼 年末調整に係る定額減税のための申告書 兼 所得金額調整控除申告書).

Below are the display conditions for the "Application for Basic Exemption" (基礎控除申告書), which determines the basic exemption based on salary, the “Application for Exemption for Spouse” (配偶者控除等申告書) needed to claim spouse exemption (配偶者控除) and special exemption for spouse (配偶者特別控除), and the “Application for Exemption of Amount of Income Adjustment” (所得金額調整控除申告書) required to claim the income adjustment deduction.

画像を表示する

画像を表示する

Conditions to display information on the Application for Basic Exemption (基礎控除申告書)

- Employment income is 20 million yen or less (OR estimated earnings are 25 million yen or less), and income tax classification falls under Column 甲 (Kou)

Conditions for the flat-amount tax cut (定額減税) checkbox to be appear for the applicant themselves

- Being a resident of Japan

- Total annual earnings not exceeding 18.05 million (= income not exceeding 20 million yen if they only have employment income)

- Classified under Column 甲 (Kou)

Conditions to display information on the Application for Exemption for Spouse

- Total earnings are 10 million yen or less

- Spouse’s total earnings are 1.33 million yen or less

- Answered “This year” in “Years your spouse has been your dependent”

Conditions for the flat-amount tax cut (定額減税) checkbox to be marked for the applicant's spouse who is sharing living expenses

- Being a resident of Japan

- Total annual earnings not exceeding 480,000 yen (= income not exceeding 1.03 million yen if they only have employment income)

Conditions to display information on the Application for Exemption of Amount of Income Adjustment (所得金額調整控除申告書)

The information is displayed if your employment income is over 8.5 million yen and any of the following conditions are met:

- You are a person with special disabilities (特別障害者)

- A spouse sharing living expenses with you is a person with special disabilities (特別障害者)

- Your dependent relative is a person with special disabilities (特別障害者)

- You have a dependent relative who is under the age of 23 (born on or after January 2, 2002)

- A relative for whom an income earner other than you receives deductions is a person with special disabilities (特別障害者) (*)

- A relative for whom an income earner other than you receives deductions is under the age of 23 (born on or after January 2, 2002) (*)

Application for Deduction for Insurance Premiums for Employment Income Earner (給与所得者の保険料控除等申告書)

The conditions to be displayed on the document to apply for insurance premium deductions are as follows.

画像を表示する

画像を表示する

Conditions to display life insurance premium deductions

- A general life premium has been entered

- A nursing care insurance premium has been entered

- A personal pension premium has been entered

Conditions to display earthquake insurance premium deductions

- An earthquake insurance premium has been entered

Conditions to display social insurance premium deductions

- National pension or national health insurance premiums have been entered

Conditions to display small business mutual aid premium deductions

- A small business mutual aid premium has been entered

Application for Special Credit for Loans Related to a Dwelling (Specific Additions or Improvements) for Employment Income Earner (Form for those who started residing by 2018) (給与所得者の(特定増改築等)住宅借入金等特別控除申告書)

The conditions to be displayed on the housing loan deductions application (form for those who started residing by 2018) are as follows:

画像を表示する

画像を表示する

| Item | Data or conditions |

|---|---|

| ①-A | For newly-built or purchased housing, displays the total year-end balance if the loan breakdown from the financial institution covers housing only If it is a joint liability, displays the total amount you are responsible for |

| ①-B | For newly-built or purchased housing, displays the total year-end balance if the loan breakdown from the financial institution covers land only If it is a joint liability, displays the total amount you are responsible for |

| ①-C | For newly-built or purchased housing, displays the total year-end balance if the loan breakdown from the financial institution covers both the house and land If it is a joint liability, displays the total amount you are responsible for |

| ⑥ | For renovation and extension, displays the total year-end balance from the lending financial institution (借入金融機関). If it is a joint liability, displays the total amount you are responsible for |

| ②-A | Displays the amount in Column ロ (Ro) of the certificate |

| ②-B | Displays the amount in Column ホ (Ho) of the certificate |

| ②-C | Displays the "total amount for ロ (Ro) and ホ (Ho)" or the "total amount for ホ (Ho) and リ (Ri)" of the certificate |

| ⑦ | Displays the amount in Column リ (Ri) of the certificate |

| ③-A | ・Displays the numbers in Column 二 (Ni) of the certificate ・Displays the numbers in Column ハ (Ha) of the certificate ・Displays the percentage of 二 (Ni) divided by ハ (Ha). Calculated to the 4th decimal place and rounded up to the 3rd decimal place. Note: 100% is always displayed when the calculation results in 90% or higher. |

| ③-B | ・Displays the numbers in Column ト (To) of the certificate ・Displays the numbers in Column ヘ (He) of the certificate ・Displays the percentage of ト (To) divided by ヘ (He). Calculated to the 4th decimal place and rounded up to the 3rd decimal place. Note: 100% is always displayed when the calculation results in 90% or higher. |

| ③-C | ・If the percentage in ③-A and ③-B is the same, ③-A is displayed ・If the percentage in ③-B and ⑧ is the same, ⑧ is displayed ・If percentages are different, nothing is displayed |

| ⑧ | ・Displays the numbers in Column ヌ (Nu) of the certificate ・Displays the numbers in Column リ (Ri) of the certificate ・Displays the percentage of ヌ (Nu) divided by リ (Ri). Calculated to the 4th decimal place and rounded up to the 3rd decimal place. Note: 100% is always displayed when the calculation results in 90% or higher. |

| ④-A | Displays either ①-A or ②-A, whichever is the lowest |

| ④-B | Displays either ①-B or ②-B, whichever is the lowest |

| ④-C | Displays either ①-C or ②-C, whichever is the lowest |

| ⑨ | Displays either ⑥ or ⑦, whichever is the lowest |

| ⑤-A | Displays the result of the calculation: ( ④-A x ③-A ) |

| ⑤-B | Displays the result of the calculation: ( ④-B x ③-B ) |

| ⑤-C | ・If ③-A and ③-B, or ③-B and ⑧ are the same percentage, displays the result of the calculation: ( ④-C × ③-C ) ・If the percentages of ③-A and ③-B, or the percentages of ③-B and ⑧ are different, the result is calculated using the following formula: ⅰ (C4){C4} × ( (A2){A2} / (C2){C2} ) × (A3){A3 percentage}% = {ⅰ} yen ⅱ (C4){C4} × ( (B2){B2} / (C2){C2} ) × (B3){B3 percentage}% = {ⅱ} yen ⅰ + ⅱ = {C⑤} yen |

| ⑩ | Displays the result of ⑨ × ⑧ |

| Maximum value for 11 | Displays the amount entered as the maximum amount |

| Value of 11 | Displays the amount for ⑤ + ⑩. If greater than the maximum value for 11 specified above, the maximum value for 11 is displayed instead. |

| Value of 12 | Displays Column ル (Ru) from the certificate |

| Maximum value for 13 | Displays the amount entered as the maximum amount |

| Value of 13 | Displays either 11 or 12, whichever is the lowest. If greater than the maximum value for 13 specified above, the maximum value for 13 is displayed instead. |

| Percentage for 14 | Displays the amount entered as the percentage for 14 |

| 14 | Displays the result of (11 x Percentage for 14). Rounds down any amount less than 100 yen. |

| The year-end balance of housing loan via joint liability | Displays the total year-end balance of a housing loan if taken out on joint liability |

| Remarks: | Displays the details for joint liability if the loan was taken out on joint liability. If C⑤ was calculated based on differing percentages, this will display that information or any notes entered in the remarks section. |

Application for Special Credit for Loans Related to a Dwelling (Specific Additions or Improvements) for Employment Income Earner and Detailed Statement and Calculation Form for Special Credit for Loans (Form for those who began residing between 2019 and 2021) (給与所得者の(特定増改築等)住宅借入金等特別控除申告書 兼 (特定増改築等)住宅借入金等特別控除計算明細書)

The conditions to be displayed on the housing loan deductions application (form for those who began residing between 2019 and 2021) are as follows:

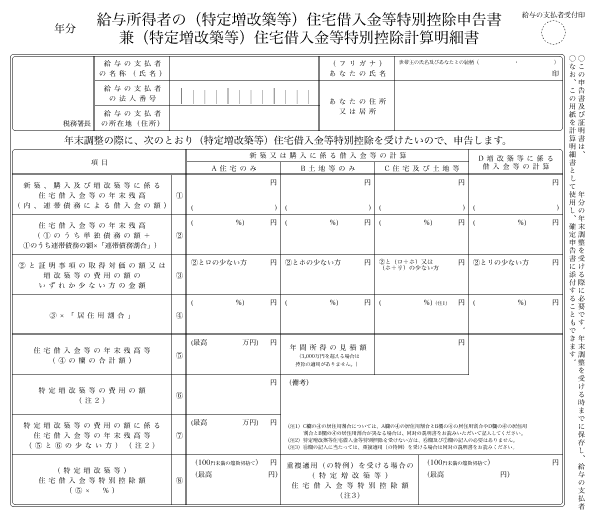

画像を表示する

画像を表示する

| Item | Data or conditions |

|---|---|

| ①-A | ・For newly-built or purchased housing, displays the total year-end balance if the loan breakdown from the financial institution covers housing only ・The year-end balance of the joint liability is shown in parentheses |

| ①-B | ・For newly-built or purchased housing, displays the total year-end balance if the loan breakdown from the financial institution covers land only ・The year-end balance of the joint liability is shown in parentheses |

| ①-C | ・For newly-built or purchased housing, displays the total year-end balance if the loan breakdown from the financial institution covers both the house and land ・The year-end balance of the joint liability is shown in parentheses |

| ①-D | ・For renovation and extension, displays the total year-end balance from the lending financial institution (借入金融機関). ・The year-end balance of the joint liability is shown in parentheses |

| ②-A | ・The percentage shows the joint liability ratio from the column 二 (Ni) on the certificate. ・Year-end balance of individual debt from ①-A + Amount of joint liability from ①-A that you are responsible for × Above joint liability ratio |

| ②-B | ・The percentage shows the joint liability ratio from the column ト (To) on the certificate. ・Year-end balance of individual debt from ①-B + Amount of joint liability from ①-B that you are responsible for × Above joint liability ratio |

| ②-C | ・The percentage shows the joint liability ratio from the column 二 (Ni) on the certificate. ・Year-end balance of individual debt from ①-C + Amount of joint liability from ①-C that you are responsible for × Above joint liability ratio |

| ②-D | ・The percentage shows the joint liability ratio from the column ヲ (Wo) on the certificate. ・Year-end balance of individual debt from ①-D + Amount of joint liability from ①-D that you are responsible for × Above joint liability ratio |

| ③-A | ・Displays either ②-A or Column ロ (Ro) from the certificate, whichever is the lowest |

| ③-B | ・Displays either ②-B or Column ホ (Ho) from the certificate, whichever is the lowest |

| ③-C | ・Displays ②-C, or ( Column ロ (Ro) + ホ (Ho) from the certificate ), or ( Column ホ (Ho) + リ (Ri) from the certificate ), whichever is the lowest |

| ③-D | ・Displays ②-D or Column リ (Ri) from the certificate, whichever is the lowest |

| ④-A | ・The percentage shows the joint liability ratio from the column ハ (Ha) on the certificate. ・③-A × Above percentage used for living space ・Rounded down to the nearest whole number |

| ④-B | ・The percentage shows the joint liability ratio from the column ヘ (He) on the certificate. ・③-B × Above percentage used for living space ・Rounded down to the nearest whole number |

| ④-C | ・If the percentage used for living space is the same for both the house only and the land only, displays the percentage used for living space from column ハ/Ha (column ヘ/He) on the certificate. ・③-C × Above percentage used for living space - Rounded up to the fourth decimal place |

| ④-D | ・The percentage shows the joint liability ratio from the column ル (Ru) on the certificate. ・③-D × Above percentage used for living space ・Rounded down to the nearest whole number |

| Maximum value for ⑤ | Displays the amount entered as the maximum amount |

| ⑤ | ④-A + ④-B + ( ④-C or ④-D ) |

| Expected annual income | ・Employee’s expected annual income ・If it exceeds 30 million yen, no deduction will be applied. |

| ⑥ | ・Displays Column ヌ (Nu) from the certificate |

| Remarks: | Displays either the employee's input or the auto-generated content based on their input. If the percentage used for living space for the house and land differ, displays the calculation formula for the percentage used for living space. |

| Maximum value for ⑦ | Displays the amount entered as the maximum amount |

| ⑦ | Displays either ⑤ or ⑥, whichever is the lowest. If greater than the maximum value for ⑦ specified above, the maximum value for ⑦ is displayed instead. |

| Percentage for ⑧ | Displays the amount entered as the percentage for ⑧ |

| Maximum value for ⑧ | Displays the amount entered as the maximum amount |

| Value of ⑧ | ・Displays the result of ( ⑤ × Percentage for ⑧) ・Rounds down any amount less than 100 yen. |

| Applying for multiple deductions at once (in the case of special exemptions, 特例) for the Special Credit for Loans Related to a Dwelling (Specific Additions or Improvements) | SmartHR does not support this scenario |

Application for Special Credit for Loans Related to a Dwelling (Specific Additions or Improvements) for Employment Income Earner and Detailed Statement and Calculation Form for Special Credit for Loans (Form for those who began residing in or after 2022) (給与所得者の(特定増改築等)住宅借入金等特別控除申告書 兼 (特定増改築等)住宅借入金等特別控除計算明細書)

The conditions to be displayed on the housing loan deductions application (Form for those who began residing in or after 2022) are as follows:

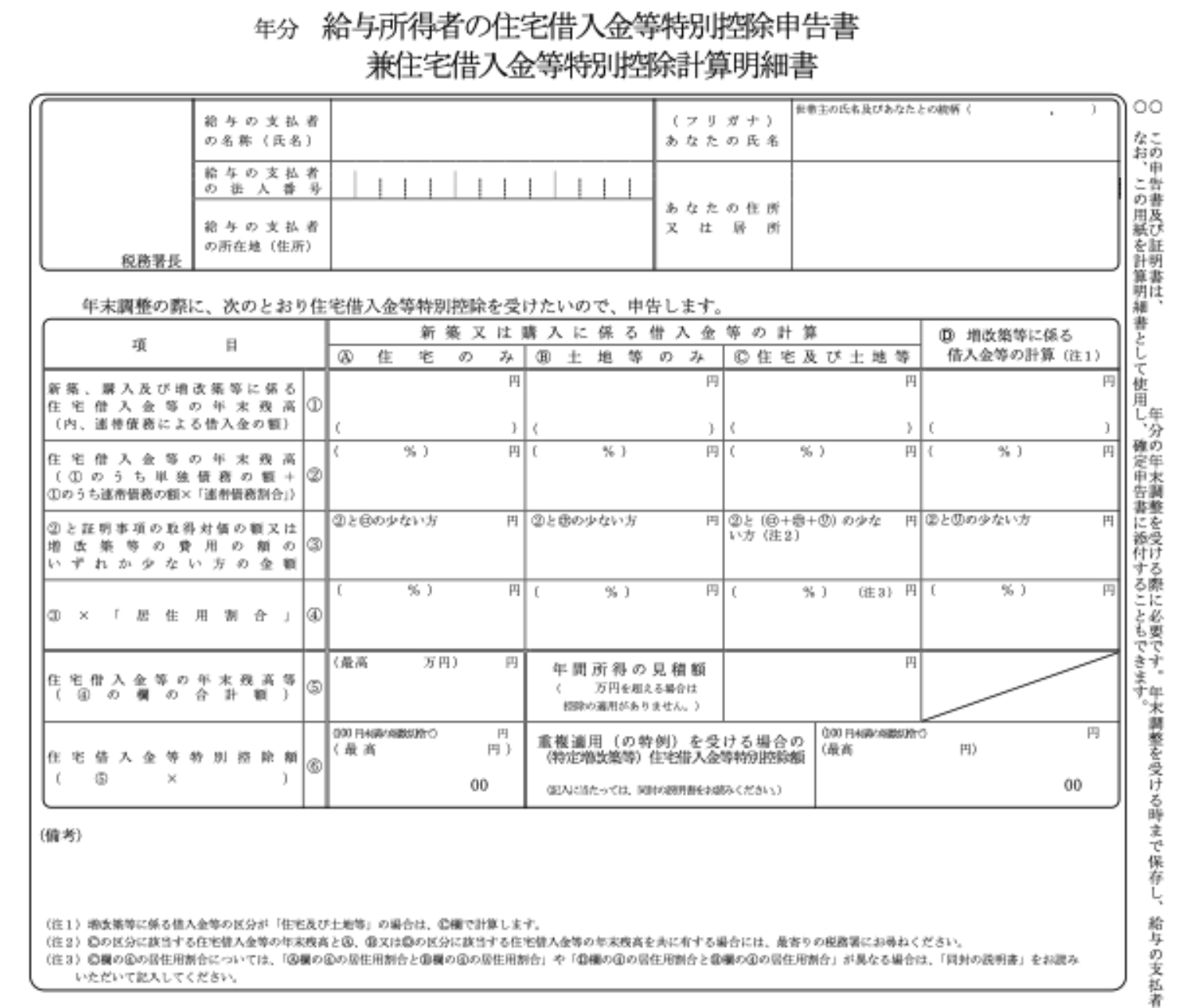

画像を表示する

画像を表示する

| Item | Data or conditions |

|---|---|

| ①-A | ・For newly-built or purchased housing, displays the total year-end balance if the loan breakdown from the financial institution covers housing only ・The year-end balance of the joint liability is shown in parentheses |

| ①-B | ・For newly-built or purchased housing, displays the total year-end balance if the loan breakdown from the financial institution covers land only ・The year-end balance of the joint liability is shown in parentheses |

| ①-C | ・For newly-built or purchased housing, displays the total year-end balance if the loan breakdown from the financial institution covers both the house and land ・The year-end balance of the joint liability is shown in parentheses |

| ①-D | ・For renovation and extension, displays the total year-end balance from the lending financial institution (借入金融機関). ・The year-end balance of the joint liability is shown in parentheses |

| ②-A | ・The percentage shows the joint liability ratio from the column 二 (Ni) on the certificate. ・Year-end balance of individual debt from ①-A + Amount of joint liability from ①-A that you are responsible for × Above joint liability ratio |

| ②-B | ・The percentage shows the joint liability ratio from the column ト (To) on the certificate. ・Year-end balance of individual debt from ①-B + Amount of joint liability from ①-B that you are responsible for × Above joint liability ratio |

| ②-C | ・The percentage shows the joint liability ratio from the column 二 (Ni) on the certificate. ・Year-end balance of individual debt from ①-C + Amount of joint liability from ①-C that you are responsible for × Above joint liability ratio |

| ②-D | ・The percentage shows the joint liability ratio from the column ヲ (Wo) on the certificate. ・Year-end balance of individual debt from ①-D + Amount of joint liability from ①-D that you are responsible for × Above joint liability ratio |

| ③-A | ・Displays either ②-A or Column ロ (Ro) from the certificate, whichever is the lowest |

| ③-B | ・Displays either ②-B or Column ホ (Ho) from the certificate, whichever is the lowest |

| ③-C | ・Displays ②-C, or ( Column ロ (Ro) + ホ (Ho) from the certificate ), or ( Column ホ (Ho) + リ (Ri) from the certificate ), whichever is the lowest |

| ③-D | ・Displays ②-D or Column リ (Ri) from the certificate, whichever is the lowest |

| ④-A | ・The percentage shows the joint liability ratio from the column ハ (Ha) on the certificate. ・③-A × Above percentage used for living space ・Rounded down to the nearest whole number |

| ④-B | ・The percentage shows the joint liability ratio from the column ヘ (He) on the certificate. ・③-B × Above percentage used for living space ・Rounded down to the nearest whole number |

| ④-C | ・If the percentage used for living space is the same for both the house only and the land only, displays the percentage used for living space from column ハ/Ha (column ヘ/He) on the certificate. ・③-C × Above percentage used for living space - Rounded up to the fourth decimal place |

| ④-D | ・The percentage shows the joint liability ratio from the column ル (Ru) on the certificate. ・③-D × Above percentage used for living space ・Rounded down to the nearest whole number |

| Maximum value for ⑤ | Displays the amount entered as the maximum amount |

| ⑤ | ④-A + ④-B + ( ④-C or ④-D ) |

| Expected annual income | ・Employee’s expected annual income ・If it exceeds 30 million yen, no deduction will be applied. |

| Percentage for ⑥ | Displays the amount entered as the percentage for ⑥ |

| Maximum value for ⑥ | Displays the amount entered as the maximum amount |

| Value of ⑥ | ・Displays the result of ( ⑤ × Percentage for ⑥ ) ・Rounds down any amount less than 100 yen. |

| Applying for multiple deductions at once (in the case of special exemptions, 特例) for the Special Credit for Loans Related to a Dwelling (Specific Additions or Improvements) | SmartHR does not support this scenario |

| Remarks: | Displays either the employee's input or the auto-generated content based on their input. If the percentage used for living space for the house and land differ, displays the calculation formula for the percentage used for living space. |