What to do if you have a spouse or dependent relative who received a resignation allowance

- Readership:

- Administrators

- Plans:

- Simple HRHR Essentials0 YenHR Strategy

New items concerning “Spouse and dependent relatives with resignation allowances, etc.” were added to “Matters related to inhabitant tax” in the “Application for (Change in) Exemption for Dependents” submitted from 2023 due to the tax reform in 2022.

This page explains about the new items, and what to do when you have an applicable spouse or dependent relatives.

People who must respond to these items

- People with a spouse whose total earnings would have been 1.33 million yen or less without a resignation allowance making them a dependent this year, but who will no longer be a dependent this year because their total earnings exceeded 1.33 million yen due to receiving a resignation allowance

- People with a family member whose total earnings would have been 480,000 yen or less without a resignation allowance making them a dependent this year, but who will no longer be a dependent this year because their total earnings exceeded 480,000 yen due to receiving a resignation allowance

Overview and background for the newly added items

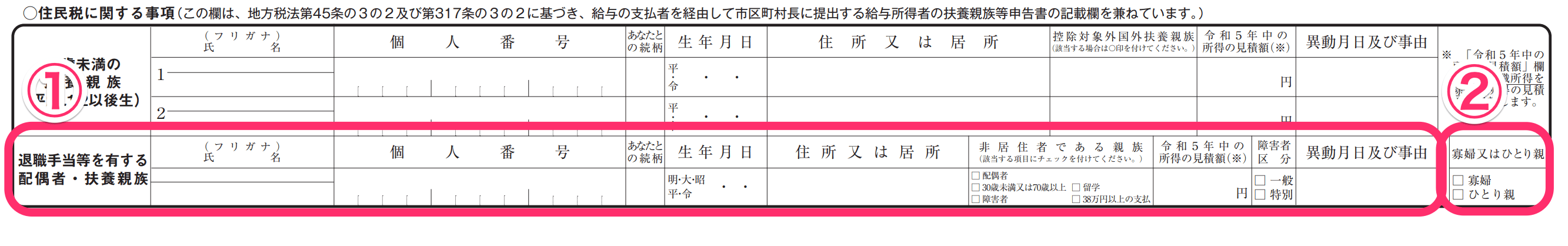

The following two items were added to “Matters related to inhabitant tax” in the “Application for (Change in) Exemption for Dependents” submitted from 2023.

- The “Spouse and dependent relatives with resignation allowances, etc.” field: Must be filled in if you have a spouse (who shares living expenses with you and whose total estimated amount of earnings excluding resignation earnings is 1.33 million yen or less) or a dependent relative who receives a payment such as a resignation allowance

- The “Widow or single parent” field: This check box must be selected if the householder filing the return qualifies as a widow or single parent due to having a dependent relative with a total estimated amount of earnings excluding resignation earnings of 480,000 yen or less

画像を表示する

画像を表示する

Background

Whether the amount of resignation earnings taxed separately is included in the “total earnings amount” for the spouse or dependent relative is different for income tax and inhabitant tax. If you have a spouse or dependent relative who received a resignation allowance or similar payment, there are cases in which dependent deductions can be applied for inhabitant tax when the total earnings amount calculated without including resignation earnings is 1.33 million yen or less for a spouse and 480,000 yen or less for a dependent relative. Therefore, these items were newly added due to the problem of some cases in which inhabitant tax deductions were not applied because the spouse or dependent relative is no longer considered a dependent for income tax purposes.

What to do if you have an applicable spouse or dependent relative

If you have an applicable spouse or dependent relative, please answer the survey as follows to receive the correct inhabitant tax deductions.

For a spouse

- For question 54: “Please enter information about your spouse (配偶者の情報を入力してください),” select “Next year (来年扶養する)” or “Not a dependent (扶養しない)”

- Select the check box for “No longer a dependent because they received a resignation allowance this year (今年退職手当を受け取ったことで扶養から外れた場合)”

- Enter information about your spouse

The entered information is updated in the “Spouse and dependent relatives with resignation allowances” field.

For a dependent relative

Even if you have a family member who is no longer considered a dependent under the tax act because they received a resignation allowance, you will need to proceed with your answers as having dependents under the tax act.

- For question 38: “Do you have dependents under the tax act? (あなたが扶養する家族(税法上の扶養家族)はいますか?),” select “Yes (はい)”

- For question 40: “Please enter information for your dependents (other than your spouse) (扶養家族(配偶者以外)の情報を入力してください),” select “Next year (来年扶養する)” or “Not a dependent (扶養しない)” concerning the dependent status of the applicable family member

- Select the check box for “No longer a dependent because they received a resignation allowance this year (今年退職手当を受け取ったことで扶養から外れた場合)”

- Enter information about your family

The entered information is updated in the “Spouse and dependent relatives with resignation allowances” field.

Important points for when the supervisor directly edits the collected information

The following cases are not supported when the supervisor collects the information and edits it directly without the employee answering the survey.

- A person who does not qualify as a widow for income tax purposes but qualifies as a widow for inhabitant tax purposes

- Since “Widow” cannot be indicated under “Matters related to inhabitant tax” in the “Application for (Change in) Exemption for Dependents,” please fill in this information by hand.

- A person who does not qualify as a single parent for income tax purposes but qualifies as a single parent for inhabitant tax purposes

- This does not affect the indications in the “Application for (Change in) Exemption for Dependents.” However, “Reason for widow/single parent: Spouse or dependent relative is no longer a dependent because they received a resignation allowance this year” will not be indicated in the “Employee Information CSV.”

Example of information updated in documents

For example, when you have the following dependent relatives, you are not eligible for income tax deductions but are eligible for inhabitant tax deductions.

- Employment income: 1 million yen (Employment earnings: 450,000 yen)

- Resignation pay: 10 million yen (Resignation earnings: 300,000 yen)

In this case, information about the dependent relative is not updated in the B column “Dependent relatives qualified for deductions” of the “Application for (Change in) Exemption for Dependents” but is updated in the “Spouse and dependent relatives with resignation allowances, etc.” field. When the householder meets the requirements of a widow or single parent, the “Widow or single parent” field is automatically determined based on whether or not there is a dependent relative who received a resignation allowance.

Furthermore, if there is an applicable spouse and multiple dependent relatives, multiple copies of the “Application for (Change in) Exemption for Dependents” will be created.