Conditions for Non-Eligibility for Housing Loan Deduction Application

- Readership:

- Administrators

- Plans:

- Simple HRHR Essentials0 YenHR Strategy

This article explains when you are not able to create an application form for housing loan deductions using SmartHR's year-end adjustment feature.

We also introduce specific examples of what kind of answers lead to non-eligibility for creating the application form via SmartHR.

- Non-eligibility conditions

- Who cannot apply for housing loan deduction via year-end adjustment

- Who cannot create a housing loan deductions application via SmartHR

- (*1) If they started living in the home between 2019 and 2021, have the relevant forms, and have different joint liability percentages listed in “家屋に関する連帯債務割合(ニ欄)” (Joint liability ratio for the house, Column Ni) and “土地に関する連帯債務割合(ト欄)” (Joint liability ratio for the land: Column To):

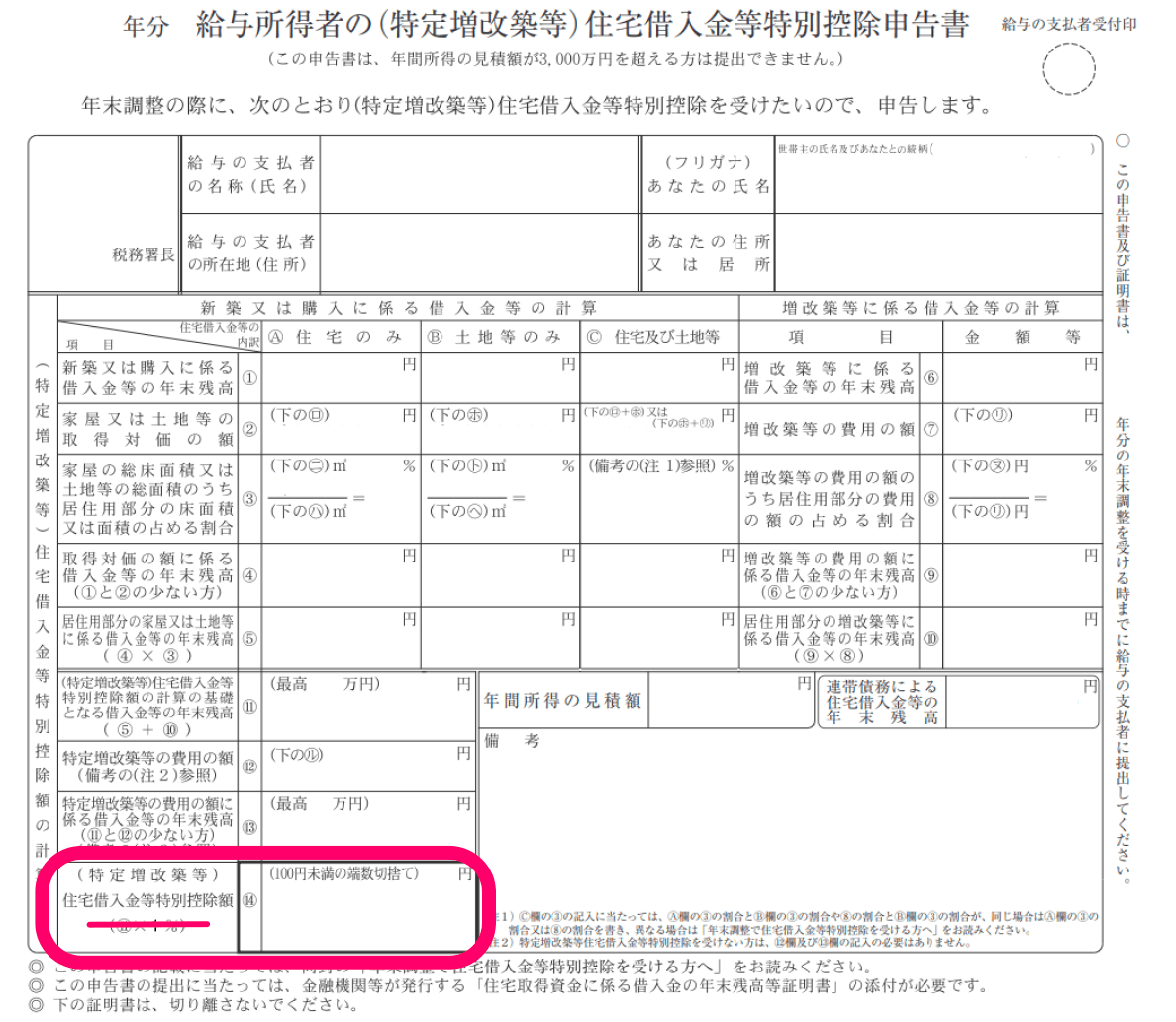

- (*2) If they started living in the home before 2018, have the relevant forms, and have a strikethrough in section 14 of their home loan deduction application form:

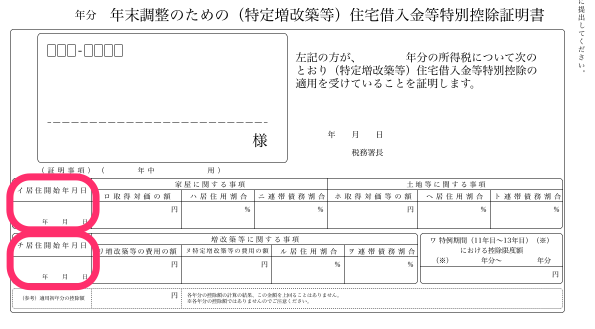

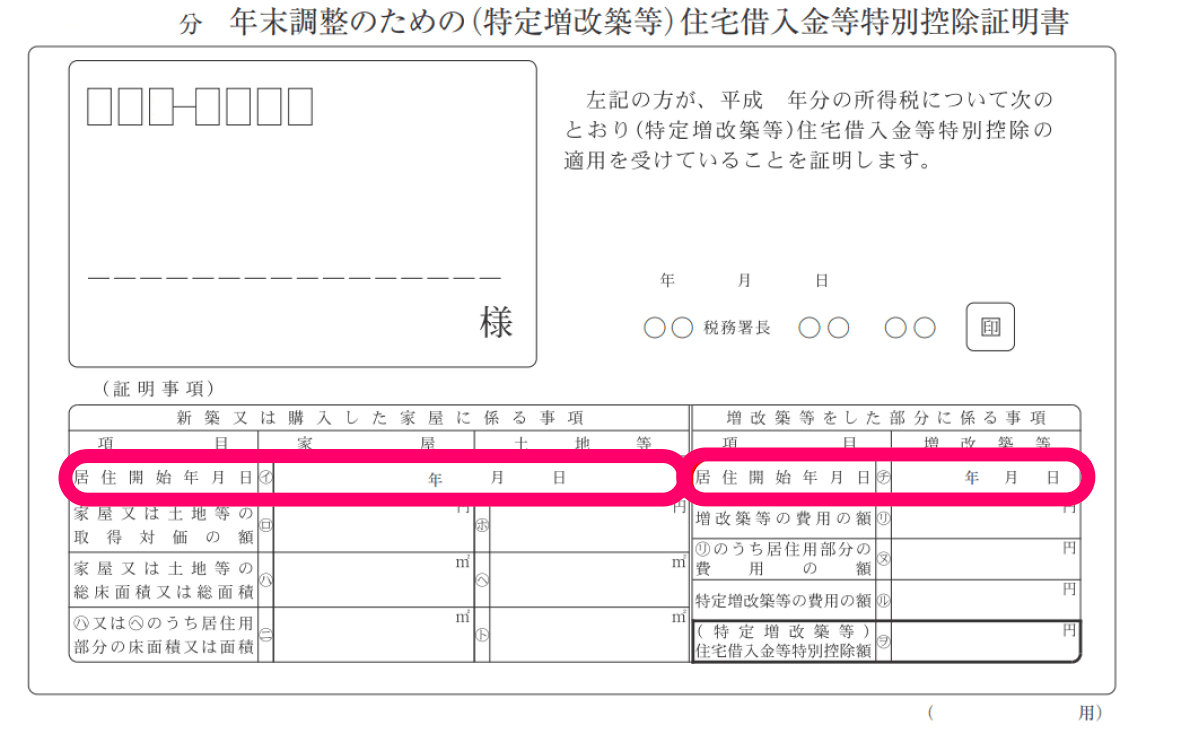

- (*3) If they are applying for deductions for both home purchase and renovation, with dates listed in both column イ (I) and column チ (Chi):

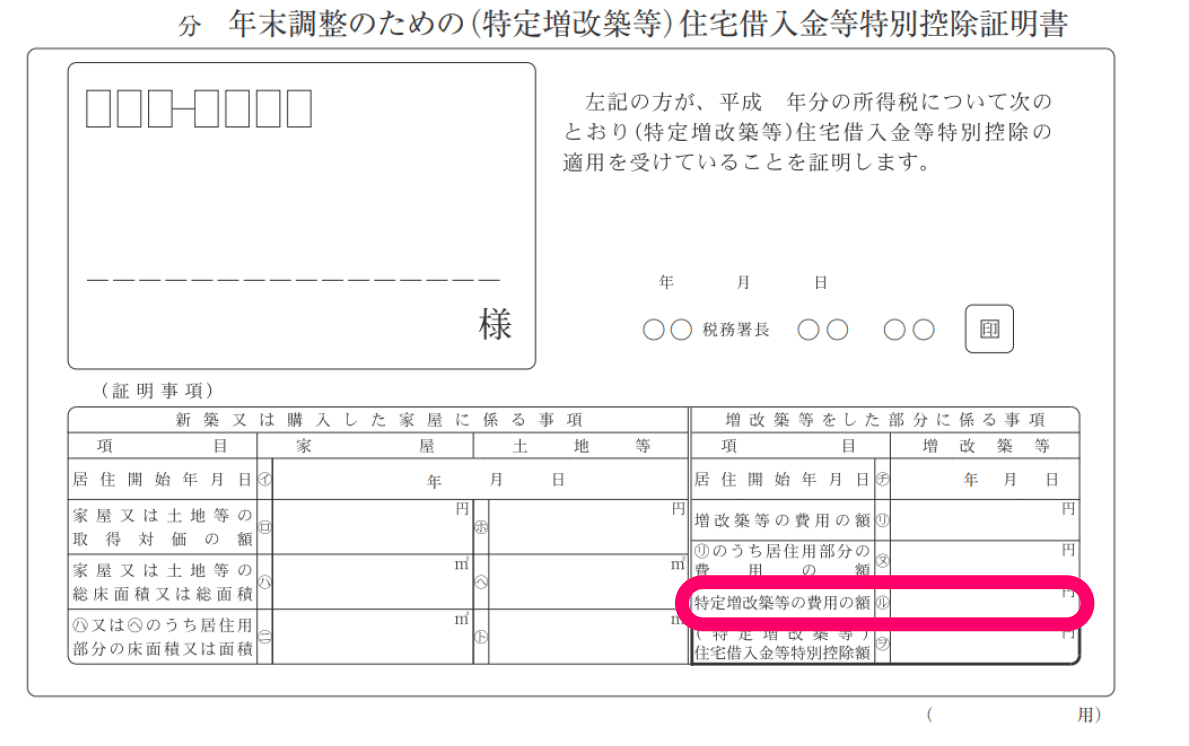

- (*4) If an amount is listed under “特定増改築等の費用の額” (Sum of expenses for specific improvements or additions)”

- (*5) If amounts are listed in two separate rows for each item on the housing loan deduction application, or if documents are split across two pages

- (*6) If they are applying for multiple deductions at once (in the case of special exemptions, 特例):

- Three cases where questionnaire responses make an employee ineligible to create the application

Non-eligibility conditions

An employee is not eligible to create a housing loan deductions application via SmartHR under any of these conditions.

Who cannot apply for housing loan deduction via year-end adjustment

- If they took out a housing loan this year (2024) and are in their first year after moving (*)

- If their housing loan deduction period has already ended

- If they are not living at this house as of December 31 of this year (2024) (does not include temporary situations such as moving away from your family for work)

- If they began living in this house on or before December 31, 2021 and their total earnings (所得, not income!) exceed 30 million yen

- If they began living in this house on or after January 1, 2022 and their total earnings (所得, not income!) exceed 20 million yen

- If special conditions acquisitions (特例特別特例取得) apply to them and their total earnings (所得, not income!) exceed 10 million yen

- If Special Residential Property (特例居住用家屋) or Special Certified Housing (特例認定住宅等) deductions category applies to them and their total earnings (所得, not income!) exceed 10 million yen

- If they have refinanced with a repayment period of less than 10 years

(*) An employee cannot declare their housing loan deductions via the year-end adjustment. Instead, they need to file the final tax return (確定申告).

Who cannot create a housing loan deductions application via SmartHR

- If they have refinanced their loan multiple times

- If they have multiple joint liabilities

- If they are borrowing from three or more financial institutions

- If they started living in the home between 2019 and 2021, have the relevant forms, and have different joint liability percentages listed in “家屋に関する連帯債務割合(ニ欄)” (Joint liability ratio for the house, Column Ni) and “土地に関する連帯債務割合(ト欄)” (Joint liability ratio for the land: Column To) (*1)

- If they started living in the home before 2018, have the relevant forms, and have a strikethrough in section 14 of your home loan deduction application form (*2)

- If they are applying for deductions for both home purchase and renovation, with dates listed in both column イ (I) and column チ (Chi) (*3)

- If an amount is listed under “特定増改築等の費用の額” (Sum of expenses for specific improvements or additions)” (*4)

- If amounts are listed in two separate rows for each item on the housing loan deduction application, or if documents are split across two pages (*5)

- If they are applying for multiple deductions at once (in the case of special exemptions, 特例) (*6)

(*1) If they started living in the home between 2019 and 2021, have the relevant forms, and have different joint liability percentages listed in “家屋に関する連帯債務割合(ニ欄)” (Joint liability ratio for the house, Column Ni) and “土地に関する連帯債務割合(ト欄)” (Joint liability ratio for the land: Column To):

Applies if the percentages in the sections circled in red are different on their documents.

画像を表示する

画像を表示する

(*2) If they started living in the home before 2018, have the relevant forms, and have a strikethrough in section 14 of their home loan deduction application form:

Applies if there is a strikethrough line in the section circled in red.

画像を表示する

画像を表示する

(*3) If they are applying for deductions for both home purchase and renovation, with dates listed in both column イ (I) and column チ (Chi):

Applies if there is a date printed in the sections circled in red.

| Format after 2020 | Format before 2020 |

|---|---|

画像を表示する 画像を表示する |  画像を表示する 画像を表示する |

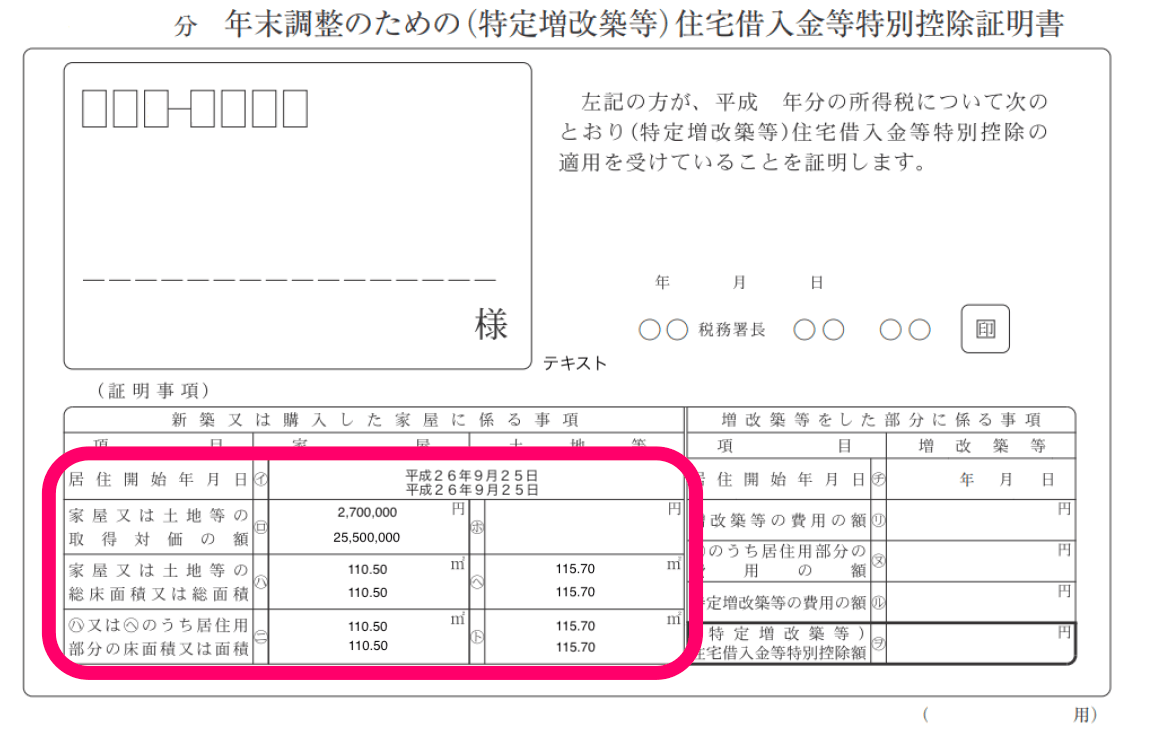

(*4) If an amount is listed under “特定増改築等の費用の額” (Sum of expenses for specific improvements or additions)”

Applies if there is a figure printed in the sections circled in red.

| Format after 2020 | Format before 2020 |

|---|---|

画像を表示する 画像を表示する |  画像を表示する 画像を表示する |

(*5) If amounts are listed in two separate rows for each item on the housing loan deduction application, or if documents are split across two pages

Applies if the amount circled in red is written in two separate rows, or if there are any documents split across two sheets.

画像を表示する

画像を表示する

(*6) If they are applying for multiple deductions at once (in the case of special exemptions, 特例):

For more details on the special exemptions for duplicate deductions, see Ⅰ‐3 住宅借入金等特別控除等の特例|国税庁別タブで開く (Japanese only).

Three cases where questionnaire responses make an employee ineligible to create the application

Based on the answers to the year-end adjustment questions, our system determines whether a home loan deduction application form should be created for the employee. If an employee is unable to create the application form despite having a housing loan, please check their answers to the following three questions in the questionnaire. If any of the following apply, the employee is considered to be non-eligible to create the application form.

- Question 200: Answered [No] (いいえ) to “Would you like to declare any housing loan deductions? (年末調整で住宅ローン控除を申告しますか?)”

- Question 201: Answered [I am not eligible] (対象外に該当する) on the page that says “This is to check whether the housing loan deductions application can be created on SmartHR” (SmartHRで住宅ローン控除申告書を作成できるかどうか確認します)

- Question 217: Pressed [Next] (次へ) on the page that says “If there is a date in both fields (イ) and (チ), you cannot create a housing loan deductions application on SmartHR” (イ欄とチ欄の両方に日付がある場合、SmartHRで住宅ローン控除申告書を作成できません)

- Question 217 is shown only if [It is listed in both fields (イ) and (チ)] (イ欄とチ欄の両方にある) is chosen as the answer concerning the date in question 215 or question 245.