Specifications for displaying the total earnings amount in the "Application for Basic Exemption of Employment Income Earner and Application for Exemption for Spouse of Employment Income Earner and Application for Exemption of Amount of Income Adjustment

- Readership:

- Administrators

- Plans:

- Simple HRHR Essentials0 YenHR Strategy

For the estimated total earnings amount for this year listed in the “Application for Basic Exemption of Employment Income Earner and Application for Exemption for Spouse of Employment Income Earner and Application for Exemption of Amount of Income Adjustment” (hereafter, Application for Basic Exemption and Exemption for Spouse and Exemption of Amount of Income Adjustment), if you are not eligible for earnings amount adjustment deductions, the specifications are set to list a flat income amount based on your choices during the survey.

This page explains about the specifications for displaying the estimated total earnings amount, its background, and cases that are not included in the specifications.

In addition, it is possible to apply the correct amount in the documents instead of a flat amount. Please refer to "How to enter the actual amount" for the detailed procedure.

Specifications

If you are not eligible for earnings amount adjustment deductions, a flat income amount is listed based on your answers during the survey for the determining category in Category I of the “Application for Basic Exemption and Exemption for Spouse and Exemption of Amount of Income Adjustment.”

The field that shows the "calculation for your estimated total earnings amount this year" is only an "estimated amount." The estimated amount is regarded as the amount for the determining category used to calculate the spouse deductions amount, and a flat amount is shown by the SmartHR year-end adjustment feature.

Cases that are not included in the specifications

When you are eligible for earnings amount adjustment deductions, the amount calculated by subtracting the earnings amount adjustment deductions must be listed in your employment earnings. Therefore, the calculated amount will be displayed, not the flat amount.

Specifications background

Preliminary notes

When declaring spouse exemption, employees must calculate the "earnings amount" from their income amount. The spouse exemption amount (or special exemption for spouses amount) is determined by the category value calculated from the employee's earnings amount and their spouse's earnings amount. A complex calculation is used to calculate the earnings amount from the income amount (in other words, the amount of payment before deducting income tax, social insurance premiums, etc.).

Issues

The earnings amount can be automatically calculated on SmartHR by entering the income amount (annual income). However, entering the annual income, which is used to perform the calculation, creates some issues. Annual income includes things such as overtime payments, incentives, and bonuses.

Although all you have to do is fill out the deductions application with the estimated amount, people often do not know the accurate estimated amount for this year when answering the year-end adjustment survey. During surveys conducted by SmartHR in the past, many people responded that they did not know their annual income (estimated amount) when it was time for the year-end adjustment (年末調整時期の時点では自分の年収(見積額)がわからない).

Since the spouse exemption amount (or special exemption for spouses amount) cannot be determined unless you declare the earnings amount calculated from your annual income, SmartHR’s year-end adjustment function enters a flat amount for the employee’s annual income amount.

Specific examples

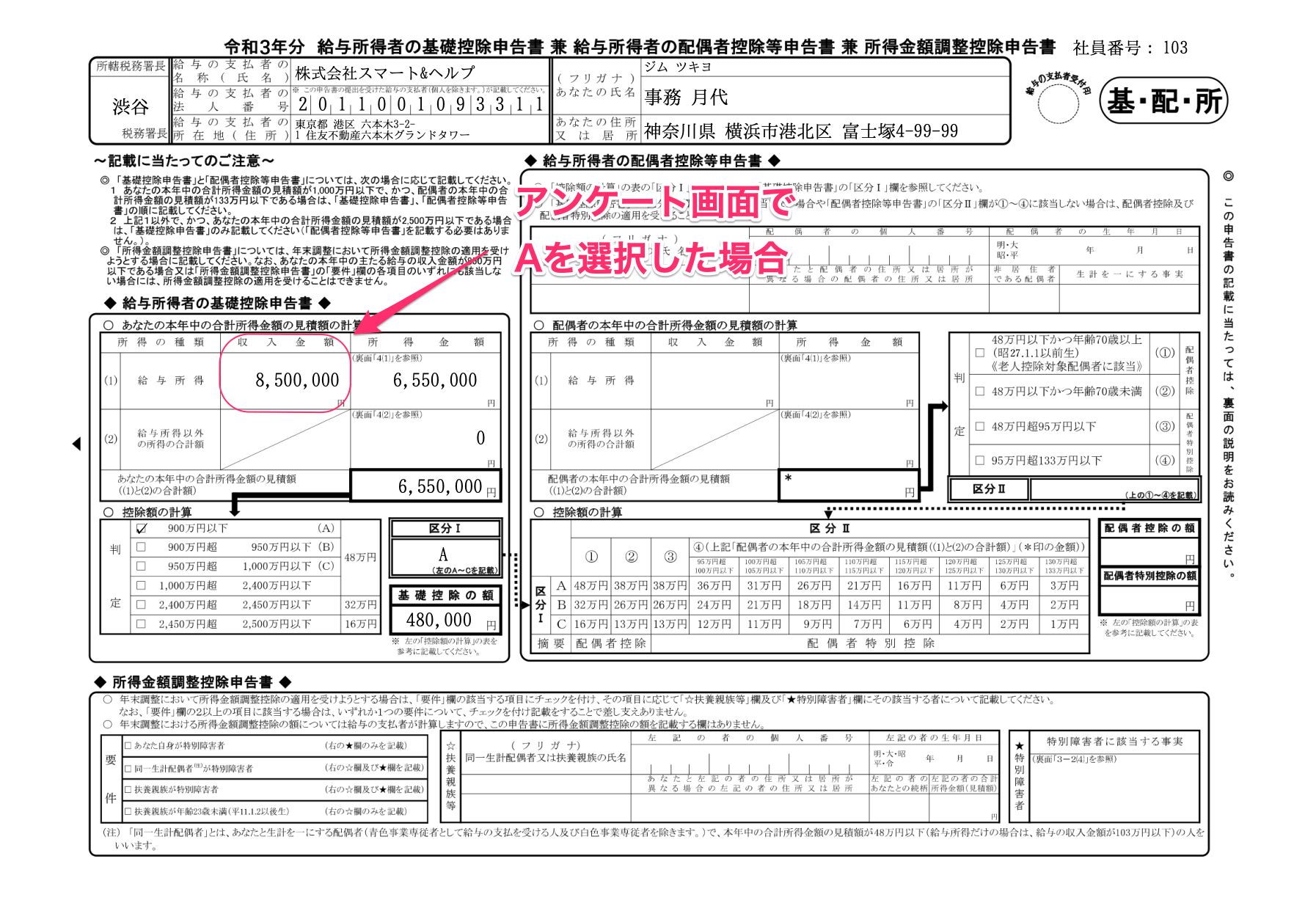

If you chose "A" for the question confirming your anticipated amount of annual income for this year

If you chose “A: Employment income of 8.5 million yen or less (6.55 million yen or less in earnings)” for question 30 “Please select your employment income for this year (今年の給与収入を選択してください).” Even if your original income amount is 8.5 million yen or less, the income amount listed in the "calculation for your estimated total earnings amount this year" shows a flat amount of 8.5 million yen (an earnings amount of 6.55 million yen).

画像を表示する

画像を表示する

If you chose “B,” the income amount shown is 10.95 million yen. If you chose “C,” the income amount shown is 11.45 million yen. If you chose “D,” the income amount shown is 11.95 million yen. If you chose “E,” the income amount shown is 20 million yen. If you chose “E,” you are not eligible for spouse exemption (special exemption for spouses).

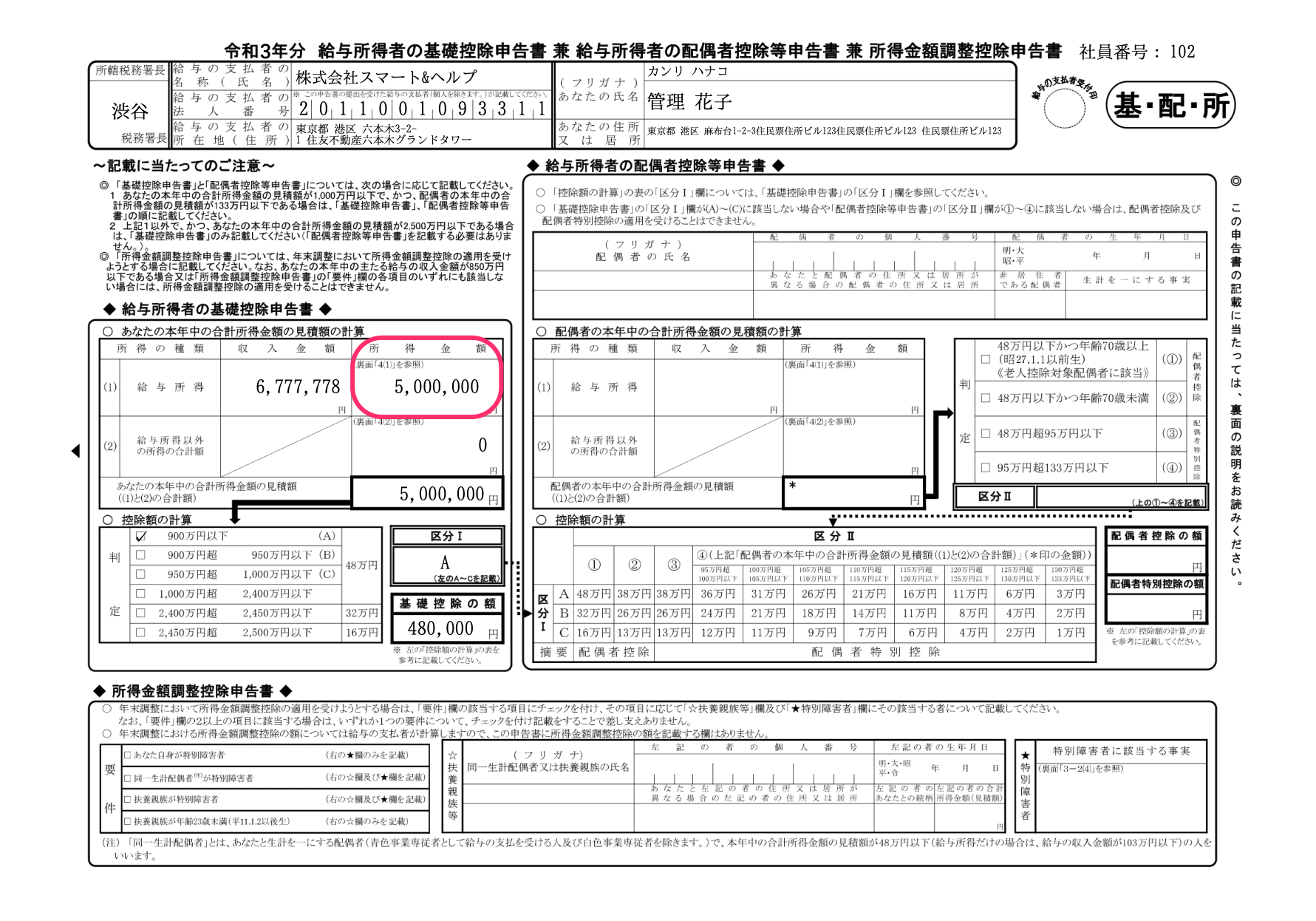

If you do not have a spouse and your total earnings this year is 5 million yen or less

If your survey answers match those below, the income amount listed in the "calculation for your estimated total earnings amount this year" will show a flat amount of 6,777,778 yen (an earnings amount of 5 million yen).

- Question 30 (Confirmation of your employment income for this year): “Please select your employment income for this year (今年の給与収入を選択してください)”

- Choose “A”

- Question 26 (Confirmation of your marital status): “Do you have a spouse? (配偶者はいますか?)”

- Choose “No (いいえ)”

- Question 46 (Confirmation whether you have had a spouse in the past): “Have you ever had a spouse in the past? (過去に配偶者がいましたか?)”

- Choose one option

- Question 44 (Confirmation of common-law marriage): “Do you have ‘Husband (not officially registered)’ or ‘Wife (not officially registered)’ listed as a relationship status on your certificate of residence? (住民票の続柄に「夫(未届)」「妻(未届)」の記載はありますか?)”

- Choose “No (いいえ)”

- Question 36 (Confirmation of your income for this year (widow conditions check)): “Are your total earnings for this year 5 million yen or less? (あなたの今年の合計所得は500万円以下ですか?)”

- Choose “Yes (はい)”

画像を表示する

画像を表示する

How to enter the actual amount

This is the procedure to answer the survey so that the correct amount is applied to the documents instead of a flat amount.

1. Press “Yes (はい)” to answer question 42 “Do you have income other than employment income?”

Press “Yes (はい)” to display question 43 “Please enter your income breakdown.”

2. Enter your income breakdown in question 43

You can enter the actual amounts for “Pension income,” “Miscellaneous earnings (besides public pension),” “Business earnings,” “Dividend earnings,” “Real estate earnings,” “Resignation earnings,” and “Other earnings” in addition to your employment income.