Who is considered a dependent under Japanese tax law?

- For:

- AdministratorsEmployees

- Plans:

- Simple HRHR Essentials0 YenHR Strategy

This page explains how to select the correct dependent status under Japanese tax law when adding family information.

Who is considered a dependent under Japanese tax law?

If the taxpayer (the employee) financially supports family members with low income, there are systems that reduce the employee’s income tax and resident tax withheld from salary.

In SmartHR, we call a spouse who qualifies for tax deductions (源泉控除対象配偶者) and dependents other than a spouse (扶養親族) a collective name “Dependents under tax law” (税法上の扶養家族)”.

Choosing “Dependent” vs “Not dependent”

When entering the dependent status under tax law, use the criteria below. For the difference between earnings (所得) and salary income (給与収入), see How to enter Estimated Annual Income (Jan–Dec)

When entering your spouse’s information

Dependent (spouse eligible for tax deduction at the source)

Select this if all of the following are true:

- Your own earnings for this year does not exceed 9,000,000 yen (salary income ≤ 10,950,000)

- Your spouse’s earnings for this year do not exceed 950,000 yen (salary income ≤ 1,500,000)*1

- Spouse is sharing living expenses with you (the employee)

- Your spouse is not a blue-return or white-return family employee (青色/白色事業専従者)

Not a dependent

Select this if the above conditions are not met or the spouse is claimed as a dependent by someone else.

When entering information for family members other than a spouse

Dependent (eligible for tax deduction at the source)

Select this if all of the following are true:

- That family member’s earnings for this year do not exceed 480,000 yen (if salary income only, ≤ 1,030,000)*2

- The person is any of the following:

- A relative other than the spouse (by blood within 6 degrees, or by marriage within 3 degrees)

- A child you have been charged to raise by the prefectural governor (meaning a foster child)

- An elderly person you have been charged to care for by the mayor of the municipality

- They are sharing living expenses with you (the employee)

- They are not a blue-return or white-return family employee (青色/白色事業専従者)

Not a dependent

Select this if the above conditions are not met or the family member is claimed as a dependent by someone else.

How to enter [Estimated Annual Earnings (Jan–Dec)]

If you chose [Dependent (eligible for tax deduction at the source)], enter [Estimated Annual Earnings (Jan–Dec)]. Here, earnings (所得) means income minus necessary expenses.

If the person has salary income only

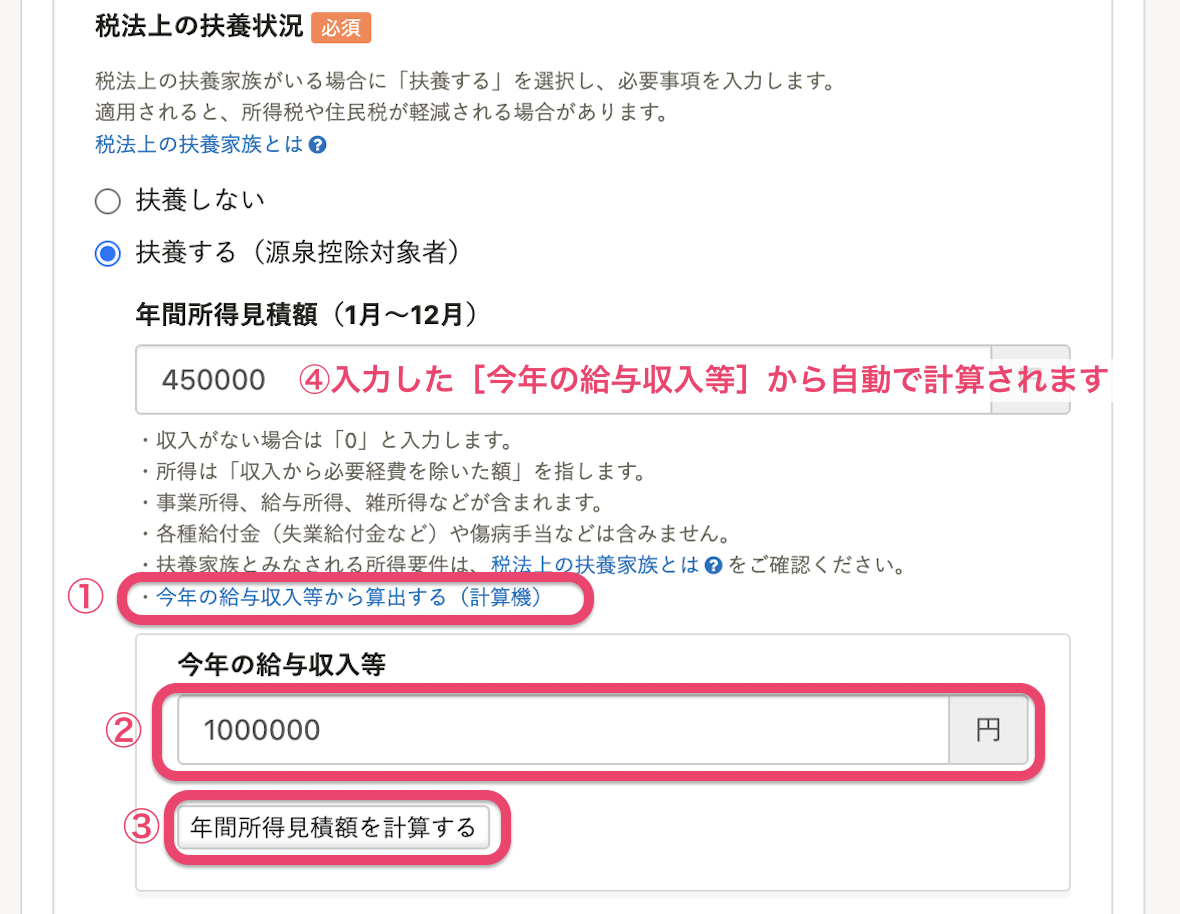

If the dependent’s income is salary only, you can calculate the earnings from salary income using the steps below.

- Click [Calculate from this year’s salary income (Calculator)]

- Enter the annual estimate in [Earnings for this year]

- Click [Calculate estimated annual income]

- The calculated amount will be auto-filled into [Estimated Annual Earnings (Jan–Dec)]

画像を表示する

画像を表示する

If there is other income:

For business income, pensions, etc., the calculation method differs.

Any of the following cases results in earnings not exceeding 480,000 yen, so the earnings requirement is met:

- Under 65 with public pension only: annual ≤ ¥1,080,000*3

- ¥1,080,000 pension − ¥600,000 public-pension deduction = ¥480,000 earnings

- 65 or older with public pension only: annual ≤ ¥1,580,000*3

- ¥1,580,000 pension − ¥1,100,000 public-pension deduction = ¥480,000 earnings

- Business income where annual revenue − necessary expenses ≤ ¥480,000*3

For detailed calculation methods, see No.1000 所得税のしくみ|国税庁別タブで開く.

For Administrators

If you have admin or operations staff privileges in SmartHR, you can choose the options below for an employee’s spouse. Use these when reflecting the results of year-end adjustment.

Admin options for the spouse

Special Spousal Deduction Eligible

Select if the spouse is not a spouse who qualifies for tax deductions but is still eligible for the Spousal Deduction or Special Spousal Deduction.

Not a dependent (spouse sharing living expenses)

Select if the spouse does not meet the above but is a spouse sharing living expenses (同一生計配偶者).

Unknown

Select if the spouse’s dependent status is unknown.